Oh ok, life experience is a valid argument when it comes from you. Please be more clear about which rules change when it's you making the argument.Life experience

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

***Official Political Discussion Thread***

- Thread in 'General' Thread starter Started by rico x hood,

- Start date

- 11,997

- 3,286

- Joined

- Dec 30, 2006

Temporary tax cuts and refund increase

Increased deficithigher if individual cuts don't expire

Permanent corporate rate cuts

Srs though this child credit finna be lit, how much them Subaru Foresters running?

8 years is a long time. And, they can be made permanent after that.

- 10,654

- 11,069

- Joined

- Jul 20, 2012

Alright so there will be no protests and backlash?

It's going to be acted out in the voting booth when we oust these ****s come midterm and then send that rat bastard packing in 2020. This tax scam will be short lived, once Dems have control everything these morons have done will be erased.

- 11,997

- 3,286

- Joined

- Dec 30, 2006

Oh ok, life experience is a valid argument when it comes from you. Please be more clear about which rules change when it's you making the argument.

I notice you didn't comment on the response with the link... figures. And yea, my life experience is a valid way to see that people give donations, all the time, without thinking of deductions. Are you arguing that this isn't the case?

- 43,224

- 28,416

- Joined

- Dec 25, 2003

Those of us who are conscious and care about things other than instant gratification understand the implications go far beyond being able to buy an extra burrito bowl each paycheck.No one is complaining about tax cuts. CNN has done a great job of making the tax plan look terrible by showing the disparity in how much people are receiving at different levels... But the average American is getting a tax cut. No one will be complaining about that when they see their paychecks rise and their tax refunds increase.

- 150,814

- 201,858

- Joined

- Mar 30, 2007

- 35,398

- 77,869

- Joined

- Dec 27, 2014

And yea, my life experience is a valid way to see that people give donations, all the time, without thinking of deductions. Are you arguing that this isn't the case?

I know people who donate to Savers specifically for the slips that give them deduction. It goes both ways. Some people will change their giving ways. It's a certainty. For others, it will make no difference. To determine to what extent goes beyond what you and I see in our everyday lives.

- 11,997

- 3,286

- Joined

- Dec 30, 2006

Those of us who are conscious and care about things other than instant gratification understand the implications go far beyond being able to buy an extra burrito bowl each paycheck.

Agreed. Our opinions just differ on the implications.

- 150,814

- 201,858

- Joined

- Mar 30, 2007

This dude in here attacking CNN like agent orange..

When you can't attack the point.. attack the messenger

If you can't dazzle em with your brilliance.. baffle em with you BS

When you can't attack the point.. attack the messenger

If you can't dazzle em with your brilliance.. baffle em with you BS

- 26,709

- 38,272

- Joined

- Jan 12, 2013

But will it be enough to offset the impending entitlement reform and the vast cuts to programs like medicaid, ...? Again, recent history has not been kind to these kind of tax cuts.Perhaps, based on misinformation. The Dem strategy is to pit lower income Americans against high earners by saying "look, they are getting WAY more because of this cut than you are." This is true. But, I believe that most people would still be happy that they are getting a cut despite others getting a bigger cut. We will see. I think that many are under the impression that their taxes are going up, or they won't get any cut, based on the media coverage.

The issues that are being discussed negatively deal more with the problem of income inequality and the wealth gap. These are real issues, but I don't think the average American cares about them that much. People will see more money in their paychecks and in their tax refunds. I think it ends up being a win for Republicans once people see the effects.

Even Reagan's cuts despite the growth resulted in a near 10% drop in federal revenue, falling far short of expectations. Then congress and George H.W. Bush had to raise taxes, as did Clinton.

The Bush tax cuts weren't exactly a success either. If even Reagan's tax cuts blew a gaping hole in the deficit and shrunk federal revenue despite such growth, why would this turn out any different?

The individual tax cuts have to be re-approved in 10 years whereas the corporate tax cuts are permanent. Sooner or later they'll have to be raised back up due to the shrinking federal revenue.

Reagan's cuts didn't pay for themselves and neither did Bush's tax cuts. I don't see how this proposal is going to get remotely close to paying for itself and the research with dynamic scoring doesn't support that either. On top of that, with Paul Ryan's dream of entitlement reform it's once again going to be the middle America fronting the bill.

How beneficial is a $1000 tax cut if the GOP causes healthcare premiums to skyrocket by further destabilizing the existing healthcare system? Or when their medical costs rise due to large cuts to medicaid, ...

You can't just look at tax cuts in a vaccuum. Most of these people are passing the tax bill knowing the recent history of large scale tax cuts in the US and dynamic scoring reports. They know this will blow up the deficit. It's why Ryan immediately jumped to entitlement reform. I assume the tax bill itself will cause plenty of protests but when Ryan tries to push through his entitlement reform you can probably expect massive protests.

https://www.washingtonpost.com/news...doing-what-hed-expect/?utm_term=.32f723a1ea88

- 43,224

- 28,416

- Joined

- Dec 25, 2003

In fairness, you're in the severe minority holding onto the opinion that this tax cut will help middle class people flourish. I don't think that's a coincidence, I think general consensus that this bill will ultimately hurt the middle class is pretty accurate.

Do you have any projections that predict this tax cut creates real economic growth, or is it all crossing your fingers relying on the pureness of other citizens?

Do you have any projections that predict this tax cut creates real economic growth, or is it all crossing your fingers relying on the pureness of other citizens?

- 11,997

- 3,286

- Joined

- Dec 30, 2006

But will it be enough to offset the impending entitlement reform and the vast cuts to programs like medicaid, ...? Again, recent history has not been kind to these kind of tax cuts.

Even Reagan's cuts despite the growth resulted in a near 10% drop in federal revenue, falling far short of expectations. Then congress and George H.W. Bush had to raise taxes, as did Clinton.

The Bush tax cuts weren't exactly a success either. If even Reagan's tax cuts blew a gaping hole in the deficit and shrunk federal revenue despite such growth, why would this turn out any different?

The individual tax cuts have to be re-approved in 10 years whereas the corporate tax cuts are permanent. Sooner or later they'll have to be raised back up due to the shrinking federal revenue.

Reagan's cuts didn't pay for themselves and neither did Bush's tax cuts. I don't see how this proposal is going to get remotely close to paying for itself and the research with dynamic scoring doesn't support that either. On top of that, with Paul Ryan's dream of entitlement reform it's once again going to be the middle America fronting the bill.

How beneficial is a $1000 tax cut if the GOP causes healthcare premiums to skyrocket by further destabilizing the existing healthcare system? Or when their medical costs rise due to large cuts to medicaid, ...

You can't just look at tax cuts in a vaccuum. Most of these people are passing the tax bill knowing the recent history of large scale tax cuts in the US and dynamic scoring reports. They know this will blow up the deficit. It's why Ryan immediately jumped to entitlement reform. I assume the tax bill itself will cause plenty of protests but when Ryan tries to push through his entitlement reform you can probably expect massive protests.

You're right about not looking at it in a vacuum. I was never under the false impression that this would pay for itself. Entitlement reform is certainly looming. I think it is a good idea. Healthcare reform is also looming. I do not think they will cut Medicaid, but perhaps stunt the growth.

The very first paragraph of your link uses the word could. Life experience is not usually considered valid evidence for an argument. It can be quite the slippery slope. Up the troll game, man. You're better than this.I notice you didn't comment on the response with the link... figures. And yea, my life experience is a valid way to see that people give donations, all the time, without thinking of deductions. Are you arguing that this isn't the case?

kdawg

Staff member

- 11,111

- 12,656

- Joined

- Jun 25, 2003

This picture quite amuses me - the staff turnover has been amazing.

- 11,997

- 3,286

- Joined

- Dec 30, 2006

In fairness, you're in the severe minority holding onto the opinion that this tax cut will help middle class people flourish. I don't think that's a coincidence, I think general consensus that this bill will ultimately hurt the middle class is pretty accurate.

Do you have any projections that predict this tax cut creates real economic growth, or is it all crossing your fingers relying on the pureness of other citizens?

To answer your question: citizens and corporations.

But, it is always amazing to me that people act like government isn't ran by citizens. You, I guess, prefer to cross your fingers and rely on the pureness of the gov't?

- 150,814

- 201,858

- Joined

- Mar 30, 2007

- 11,997

- 3,286

- Joined

- Dec 30, 2006

The very first paragraph of your link uses the word could. Life experience is not usually considered valid evidence for an argument. It can be quite the slippery slope. Up the troll game, man. You're better than this.

Everything being discussed is based on projections. Everything is a could or should and may unless you have a time machine. If so, tell me what litecoin or bitcoin will do in 2025.

- 5,712

- 1,019

- Joined

- Mar 31, 2005

I've read that the current tax bill could decrease charitable giving by as much as $13 billion. So is his claim really that unfounded?

Very possibly because a good percentage will not be itemizing anymore so why bother donating when you're not getting a deduction. Waste your time going to goodwill and dropping off bags of used clothes and household items, or just dump em in the trash that takes little effort? Also the elimination of misc. expenses/unreimbused expenses deduction... why should school teachers or workers spend money on their jobs when they can't take a deduction? Teachers won't be wasting their money buying school supplies or food for their classes anymore. Then the housing market which will more likely get the correction shortly because why buy a home, 2nd home or vacation home when your mortgage interest deduction is limited and a 10K SALT deduction. Home ownership will take a huge dive just in time for investors to scoop em up all again!

There's a pretty big difference between saying "when this thing happens" and "if this thing happens". It's not my fault if you're not clear about what you're trying to say.Everything being discussed is based on projections. Everything is a could or should and may unless you have a time machine. If so, tell me what litecoin or bitcoin will do in 2025.

- 5,712

- 1,019

- Joined

- Mar 31, 2005

To answer your question: citizens and corporations.

But, it is always amazing to me that people act like government isn't ran by citizens. You, I guess, prefer to cross your fingers and rely on the pureness of the gov't?

Govt is being run by Corporations today. Estimates say around $2.6 billion a year spent by lobbyists. The funny part... idiots in poor Red States wanted a New York Business Guy in the White House whom appointed Corporate Executives in his administration!

- 11,997

- 3,286

- Joined

- Dec 30, 2006

Govt is being run by Corporations today. Estimates say around $2.6 billion a year spent by lobbyists. The funny part... idiots in poor Red States wanted a New York Business Guy in the White House whom appointed Corporate Executives in his administration!

Lol I think this proves my point lol

- 23,012

- 33,703

- Joined

- Jul 19, 2012

8 years is a long time. And, they can be made permanent after that.

I plan on living longer than the next 8 years though so yeah.

I wonder why they didn't just make them permanent to begin with.

And how they're gonna shrink that deficit

- 5,712

- 1,019

- Joined

- Mar 31, 2005

Lol I think this proves my point lol

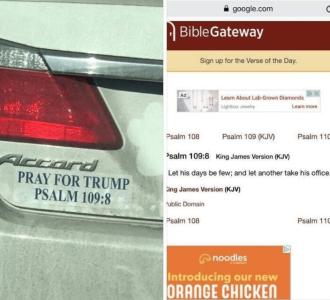

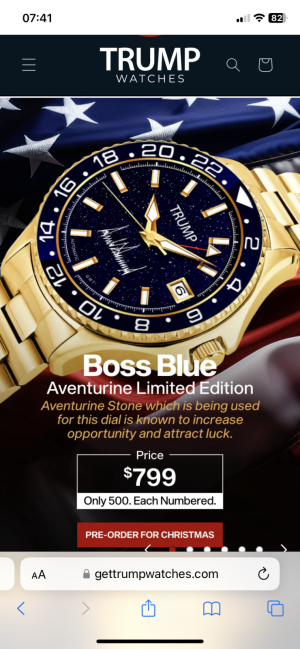

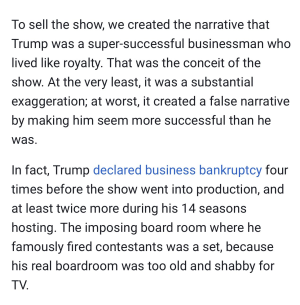

Proves your point that dummies in poor Red States were duped, deceived, tricked, hoodwinked, hoaxed by a reality star pretending he cared about em?

Like those coal jobs are coming back.. but yet.. one year later...

DONALD TRUMP HAS ONLY DELIVERED 1,200 COAL-MINING JOBS, DESPITE CLAIMING TO HAVE CREATED 45,000

http://www.newsweek.com/donald-trum...coal-mining-jobs-despite-claiming-have-751885

"But 1200 is greater than 0!"Proves your point that dummies in poor Red States were duped, deceived, tricked, hoodwinked, hoaxed by a reality star pretending he cared about em?

Like those coal jobs are coming back.. but yet.. one year later...

- dwalk probably

- 23,012

- 33,703

- Joined

- Jul 19, 2012

You, I guess, prefer to cross your fingers and rely on the pureness of the gov't?

And, they can be made permanent after that.

Similar threads

- Replies

- 106

- Views

- 16K