EddieDoyers

formerly eddiengambino

- 46,208

- 23,878

- Joined

- Apr 3, 2012

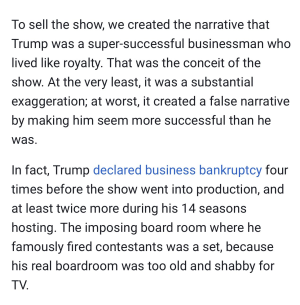

Ironically Wells Fargo cut some employees this year at their headquarters and their call centerWells Fargo and Fifth Third Bank raiding minimum wages to $15/hr on passage of the tax bill, and AT&T giving a $1000 bonus to all employees. Anyone else feel like these companies are doing this for the PR?

Even the CEO of Wells Fargo hinted at what's going to happen next year

"Is it our goal to increase return to our shareholders and do we have an excess amount of capital? The answer to both is, yes," Sloan said. "So our expectation should be that we will continue to increase our dividend and our share buybacks next year and the year after that and the year after that."

So yeah, all just PR really to front for their employee cutting and profit margin increasing tactics