Opinions | Black women saved the Democrats. Don’t make us do it again.

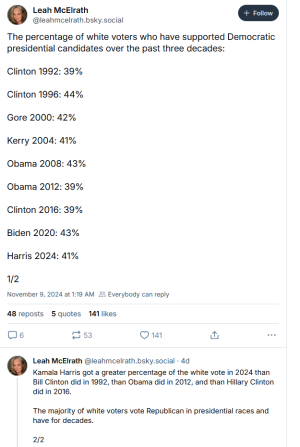

Without our support, the president-elect would be preparing a powerful speech about how despite his defeat, the nation needs to stand together as a united people to blunt the effects of President Trump’s white supremacist reign. Instead, thanks to wins powered largely by the turnout in places like Detroit, Atlanta, Milwaukee and Philadelphia, Biden and the first Black woman to serve as vice president, Kamala D. Harris, are preparing to take office.

But it’s a sure bet that even though Trump will be gone after January, the social conditions for Black citizens will remain largely the same, because you cannot vote white supremacy out

It’s the lifeblood of our nation’s political institutions. It’s the insidious undercurrent that absolves the new president-elect of his 1994 crime bill, a historic piece of federal legislation that increased funding to law enforcement agencies throughout the country. During this campaign, Biden has apologized for his previous actions, contextualized the social conditions of the early 1990s and pledged for forgiveness from Black Americans, specifically Black women.

Ya'll ready?!