- Dec 13, 2004

- 75,054

- 63,025

Luxury Slump Leads Some Swiss Watchmakers to Seek State Aid

- Girard-Perregaux and Ulysse Nardin among brands getting help

- Work stoppages follow drop in demand for Swiss watch industry

Swiss luxury watchmakers are turning to the government for financial aid to help them weather a downturn in demand.

Girard-Perregaux and Ulysse Nardin have become the first brands to confirm they’re using a state program to retain jobs and avoid permanent cuts. Sowind Group, which owns the two manufacturers, has put about 50, or 15%, of its 320 workers on so-called short-time work or furlough, according to Chairman and Chief Executive Officer Patrick Pruniaux.

“It’s a small watch crisis so far, slightly disconnected from the economy,” Pruniaux said in an interview at the Geneva Watch Days show last week. “This year is a challenge,” he added.

It follows similar moves by watch suppliers, which opted to take advantage of the government support to help navigate the industry slowdown after manufacturers cut orders.

Under the program, the Swiss state pays up to 80% of workers’ salaries as companies eliminate shifts and work hours in line with a drop in demand for their products. It’s designed to prevent permanent job cuts for manufacturing industries, such as watchmaking.

The program has been in place for decades but the watch sector tapped it extensively in 2020 when the industry temporarily shut down due to Covid-19. When restrictions were lifted, the watch brands and suppliers brought back furloughed workers and soon rushed to hire more as demand soared.

Around 40 companies in the canton of Jura, a hub for watch component makers, submitted applications for short-time work compensation during the summer, Pierre-Alain Berret, head of the Jura Chamber of Commerce and Industry, told newspaper NZZ last month. The applications represented a significant increase from the start of the year when just five companies had applied.

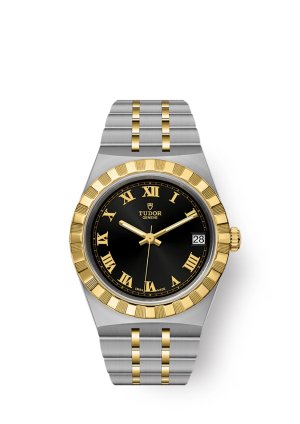

Swiss watchmakers are suffering from a sharp decline in demand, especially in China, following an unprecedented boom during the post-pandemic era when consumers rushed to buy pricey timepieces. After three straight years of record exports, wholesale watch exports have fallen by 2.4% in value in the first seven months of the year as consumers refrain from splashing out on expensive watches.

The drop in consumer demand has hit brands making slightly less expensive watches the hardest, while top-selling brands such as Rolex and Patek Philippe have been more resilient.

The slowdown has also affected Richemont, the group behind Vacheron Constantin and IWC, and Omega owner Swatch Group AG, which have both seen sales dive in China.

Sowind’s Pruniaux said there are few signs of improvement from the Chinese economy, meaning the industry might only see a partial recovery in 2025. Sowind’s sales will likely be flat or will fall slightly in 2024, he said. That compares with growth of just under 10% last year and a near-doubling of sales in 2022.

Sowind was part of Kering SA until a management buyout in 2022. Its brands produce high-end watches, with some rare Girard-Perregaux models setting buyers back as much as $500,000.

Brave Face

At Geneva Watch Days, the heads of some of the biggest brands were putting on a brave face amid the current pullback.

Breitling AG CEO Georges Kern said some suppliers and watchmakers were making drastic moves in response to the slowdown.

“Some suppliers took six, seven or eight weeks of holidays,” he said. “The talent is to balance and manage your growth both when it’s going up and also when it’s going down,” he said. Breitling expects to increase sales slightly this year, he added, citing a recent improvement in the US.

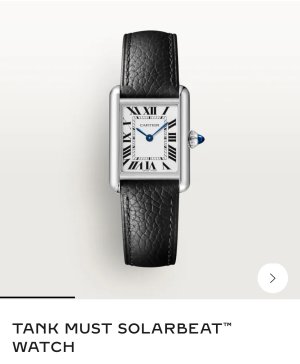

Jean-Christophe Babin, the CEO of LVMH-owned jeweler Bulgari, said he expects the crisis in China to persist for months. But Bulgari’s focus on the less volatile women’s watch market and the fact that, unusually, the brand makes the majority of its own cases, dials and movements allows it to adjust production and ride out the slowdown, he said.

Rolf Studer, CEO of Oris, said the independent brand known for its diving watches is hoping to contain a sales decline this year to single digits as the drop in demand is being made worse by the continued strength of the Swiss franc. This squeezes profit and increases relative prices for already nervous consumers.

“You’re not going to buy a mechanical watch if you think your next year won’t be as good financially,” Studer said.