- 30,103

- 21,505

- Joined

- Dec 23, 2009

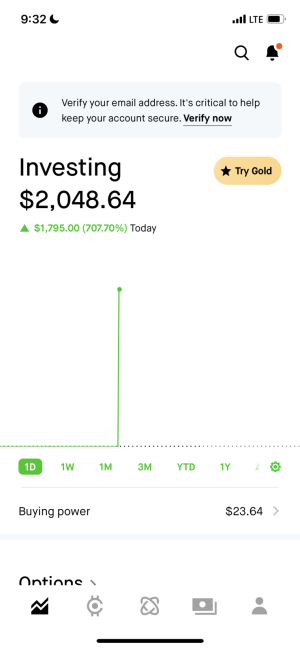

This post perfectly encapsulates why it's important to take profits when you can. I know GME isnt a long term winner, as it stands. So I placed my bets and won, and cashed out 50 of the 60 shares i went into the casino with. Now its house money so if the company turns it around and justifies their market cap and ratios, even better! If not, well that's why we take the wins when we get them.Just because it’s moving doesn’t mean something fundamentally changed. They could collapse 80% tomorrow and no one would bat an eye because based on fundamentals it’s a dead company. Only people in it are really gamblers who are tossed a few bucks into it (probably some traders too), some Reddit readers who still believe in that post, and inexperienced people who don’t understand P/E ratios and don’t read the F/S.

Like listen if you think you can make money with it because it will somehow make money, more power to you. But if the rug gets pulled up from under you don’t cry that somehow to system is flawed. You have longs and you have shorts, institutions don’t short in such a large quantity unless the fundamentals of the business are severely flawed with no future outlook.

Dont expect to learn anything except that it's all broken and makes no sense.

Dont expect to learn anything except that it's all broken and makes no sense.