- 74,729

- 24,118

- Joined

- Apr 4, 2008

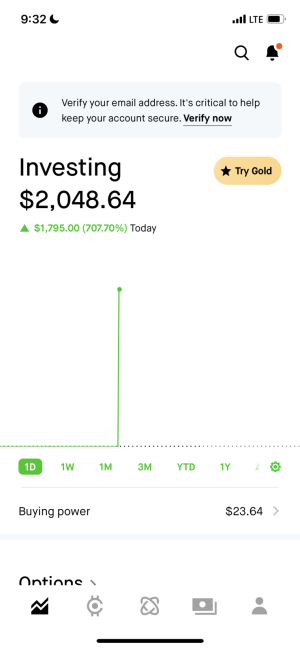

We’ve got a couple of WSBers on here whether we like to admit it or not

I addes 5 shares of ayx. This was the first target I wanted to attempt an entry at. Guidance and earnings were terrible because of covid and it will probably get worse, but long term they have a great foothold in the marketand should come back to life. Cathie Wood bought more today too

I addes 5 shares of ayx. This was the first target I wanted to attempt an entry at. Guidance and earnings were terrible because of covid and it will probably get worse, but long term they have a great foothold in the marketand should come back to life. Cathie Wood bought more today too