- Oct 16, 2010

- 2,328

- 2,078

I disagree. Obama created a very strong foundation. Although he's tried, Drumpf hasn't been able to completely **** it up yet. People are employed and spending hella money. The economy has been very strong.

Obama era/fed policy was QE and low rates, easy money, tons of buybacks, tons of corporate debt.. trump is continuing the same exact legacy and attempting to expand on it, total zombie market.

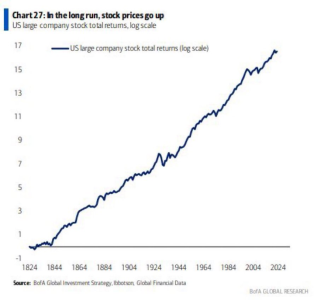

Since 2009 Global Central Banks have pumped in $15 trillion in stimulus creating an imbalance in the investment demand for and supply of quality assets(4). Long term government bond yields are now the lowest levels in the history of human civilization dating back to 1285(5). As of this summer there was $9.5 trillion worth of negative yielding debt globally. Last month Austria issued a 100-year bond with a coupon of only 2.1%(6) that will lose close to half its value if interest rates rise 1% or more. The global demand for yield is now unmatched in human history. None of this makes sense outside a framework of financial repression.

Amid this mania for investment, the stock market has begun self-cannibalizing... literally. Since 2009, US companies have spent a record $3.8 trillion on share buy-backs(7) financed by historic levels of debt issuance. Share buybacks are a form of financial alchemy that uses balance sheet leverage to reduce liquidity generating the illusion of growth. A shocking +40% of the earning-per-share growth and +30% of the stock market gains since 2009 are from share buy-backs. Absent this financial engineering we would already be in an earnings recession.

https://static1.squarespace.com/sta...s_Volatility+and+the+Alchemy+of+Risk_2017.pdf

just let her run!!

just let her run!!