- 11,999

- 3,286

You are right Delk, I have zero experience in this area. As for your question about whether it’s a hobby or qualifying business, I’ve included the test from the IRS for you.

I’m guessing you do very few of these things, but again, I know very little about how this **** works and have never run into this in practice.

Given that I know you are a lawyer, I know you don’t depend on the income. Given that you don’t know the difference between profit and loss, I can tell you probably are not keeping financial statements. Knowing you are white I know that you don’t have sufficient knowledge of the business.

If this makes you feel better about stealing money from real businesses who have real employees who depend on the business to provide them a paycheck then whatever, you do you.

I'm not going to go through the IRS factor test with you to demonstrate that my business is a business lol.

I don't need your approval for a $1000 advance on a business loan, that I don't need to repay, that the sba already approved me for.

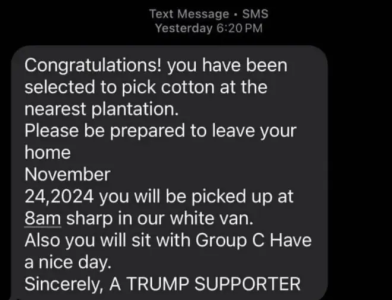

Sadly, you made a bunch of assumptions about my buying and selling. Because you know that I am black, I hope these weren't racist assumptions.

In your world, uber drivers that have regular jobs or shipt shoppers aren't independent contractors that the sba loan/advance was intended for.

I respect your opinion, but it is factually inaccurate.

The fact that you do taxes for a living makes this even more ridiculous. Do you make sweeping assumptions with your clients before finding the facts? Do you base this on the way they look?

, but no big deal.

, but no big deal.