- 13,741

- 12,966

- Joined

- Oct 14, 2008

It’s not all income though, what if I buy lunch for 5 of my co workers because it’s easier to put it on one card and they just Venmo me, which actually happens a lot because skymiles.

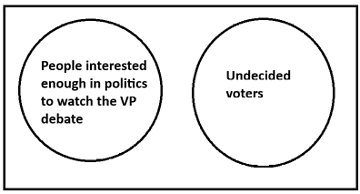

I know we haven’t been taxed yet but how are they going to differentiate? Not all online transactions are income.

Overall it’s just petty, the whole message is close the loopholes for the 1% not tax regular people for every petty thing.

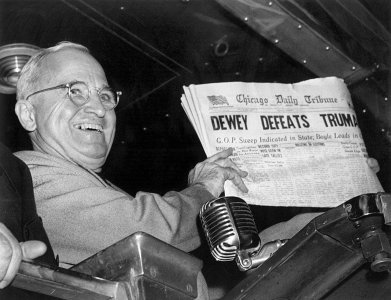

See this is the misinformation that’s spreading.

The only way PayPal and Venmo will send you a 1099 is when you use the option with payment protection with the fee. Meaning you’re doing it for a transaction and want buyer/seller protection.

If you send it friends and family then there is no 1099. But if you decide to buy or sell this way to avoid the tax, then the payment service has no reason to protect any one or you because you are assuming the risks. But no 1099.

Technically even redeeming miles, CC points, and cash back is a taxable transaction. Sometimes CCs will hit you with a 1099 but it’s pretty inconsistent. Most people don’t know this but it is income since they have a monetary value with your basis being zero so when you redeem it they can issue you a 1099 on that as well.