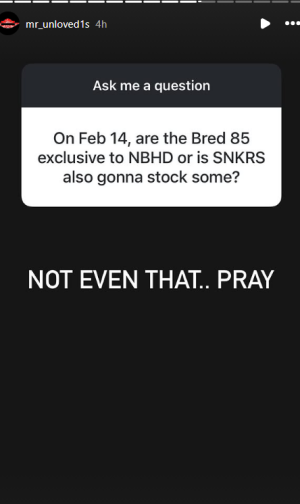

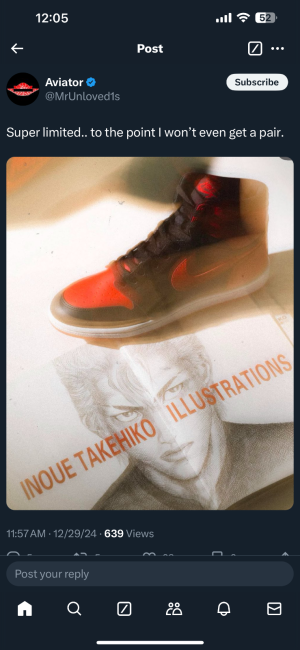

I understand this idea increased prices can dent resale on the surface, but I’m not convinced it’s really the main motivator. The reason, I suspect, Nike hasn’t just started charging resale prices for hardly anything is that it appears to me to be a smaller market than it may seem.

Nike’s trying to move hundreds of thousands of pairs. Within that buyer group are people willing to pay double, triple and more for select releases—but how many of them are there? Let’s say a release is made to the tune of 500,000 pairs. How many of those pairs truly trade on the resale market? Let’s say 100,000. That’s only 20 percent of the potential market that is actually willing to pay those prices, it’s not the majority of consumers. If Nike thought it could move these huge volumes at reseller prices, then I think it would have charged these prices for a long time already. The bottom line is that with each significant price hike on any product, it will reach a tipping point where the number of people willing or able to pay it automatically decreases. Even when we’re talking “luxury” goods and an affluent customer base. And it’s rather dubious to describe the majority of sneaker buyers as that, I suspect.

So why are these $250? Probably because Nike thinks it’s still a super hyped shoe that is so in demand and so popular that there are indeed enough people who are just willing to pay that price for this specific colorway and model, and still move all its inventory. If Nike REALLY gave a damn about killing resale, the solution is simple: make more pairs. Everything else is a smokescreen.