- 39,330

- 19,774

- Joined

- Dec 3, 2009

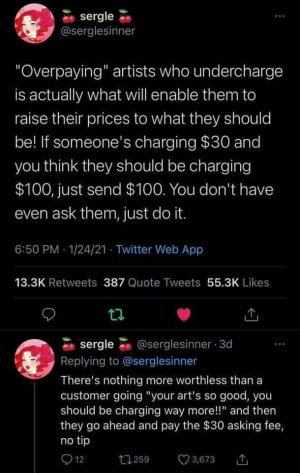

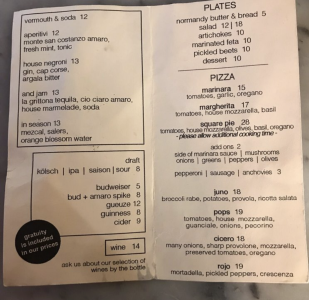

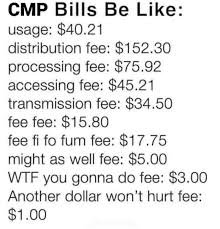

I read that you do tip when you first posted...so I'm speaking in general....remove the idea of tipping and have the waiters get paid 12$ instead of 8$ an hour, you think this is somehow will make up for what they could have made off tips?...money they get in cash instantly none-taxed? It won't....the idea of tipping incentivizes waiters and waitresses to over-perform, not all but most "kiss your ****" because of the idea of a potential tip, take that away and up their pay which at the end of the day it'll just be a paycut and watch the price of your plate go up and your service be worst.

All over what? 5-10$ extra on your dining experience, do you dudes not see how petty that *** is?

All over what? 5-10$ extra on your dining experience, do you dudes not see how petty that *** is?

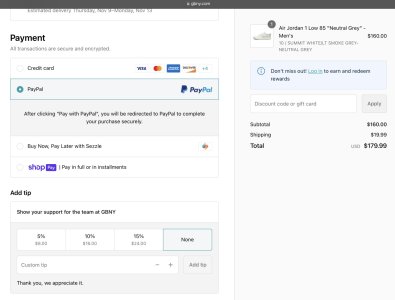

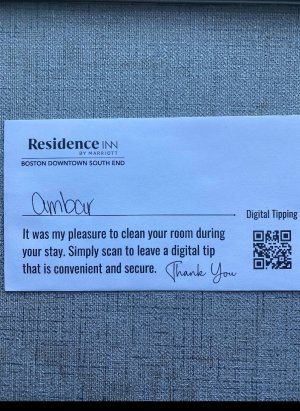

at you really thinking waiters/waitresses reporting their tips to the IRS, best believe cash tips are not reported, debit tips yeah, cash tips....NEGATIVE.

at you really thinking waiters/waitresses reporting their tips to the IRS, best believe cash tips are not reported, debit tips yeah, cash tips....NEGATIVE.