runningfishy

Banned

- 2,874

- 19

- Joined

- Sep 25, 2005

Originally Posted by secretzofwar

Originally Posted by RunningFishy

BULL CRAP.Originally Posted by secretzofwar

If you don't have much money, you'll never get rich if you diversify. Usually, if you get rich, it's via extreme concentration (and being very correct).

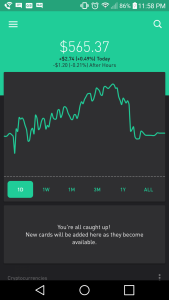

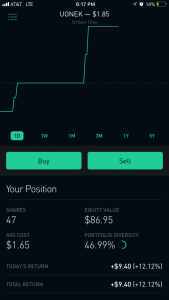

My entire 401K is in one stock.

If not, why don't you buy CALLS on a particular company. This is the dumbest idea ever.

Also, what 401K plan do you have? A lot of companies PROHIBIT 100% allocation into company stock because of the stock market crash in 2008-2009.

A bunch of looeny duck tales.

It's not what you make, it's what you don't lose. Protecting principal is the core reason why a 401k was created.

If you think something is fundamentally extremely overvalued, and don't want to worry about time frame, then the common stock >>>>core.

Diversification you can definitely protect your assets, but if you saw my other post, my 401K is a miniscule part of overall assets. I might as well put my $$ on something I think can be a 10-15 bagger than have $1500 or whatever it is sit in MSFT and ABT.

Getting rich via investments/prudent savings and wealth protection are totally different things.

You think Warren owns a lot other than BRKA? Eddie Lampert, Bruce Berkowitz, etc... a lot of these great investors take huge stakes in a few companies.

Your 401K is a miniscule part of your overall assets? You serious?

That is fundamentally and logically 'scary'!!! Unless you are a millionaire, or claim to be, the average joe and typical middle class seek retirement accounts as a 'haven'. It is why they were created in the first place.

You do sound like one of those guys that believe investing will turn you into a trillionaire or something. That's full of it, and even more so on Nike Talk. I've read these macho posts time and time again, and they make no sense. Then again, it's the internet, but come on now. What you're saying is silly. Your mentality is definitely wrong as you are just going to be paying taxes up the yin yang while trying to 'gamble' your principle.

So, what is this 'STOCK' you are even talking about?