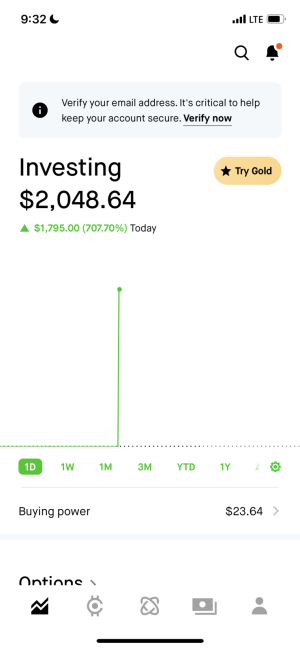

- 5,240

- 5,925

- Joined

- Dec 24, 2016

That's very true. We are in a bull market and the pullback is definitely gonna hurt when it arrives. I'm wondering how the stimmy check is gonna impact the market though. YOu know there are people who are gonna just toss it in the market. That might cause a nice pump where you can take some profitI’m more afraid of another covid variant/lockdown and for it to cause another marker crash/significant pull back

Some of those questionings were embarrassing.

Some of those questionings were embarrassing.