Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OFFICIAL STOCK MARKET AND ECONOMY THREAD VOL. A NEW CHAPTER

- Thread in 'General' Thread starter Started by johnnyredstorm,

- Start date

- 57,647

- 61,217

- Joined

- Aug 6, 2012

A Tesla split is much appreciated.

- 74,739

- 24,134

- Joined

- Apr 4, 2008

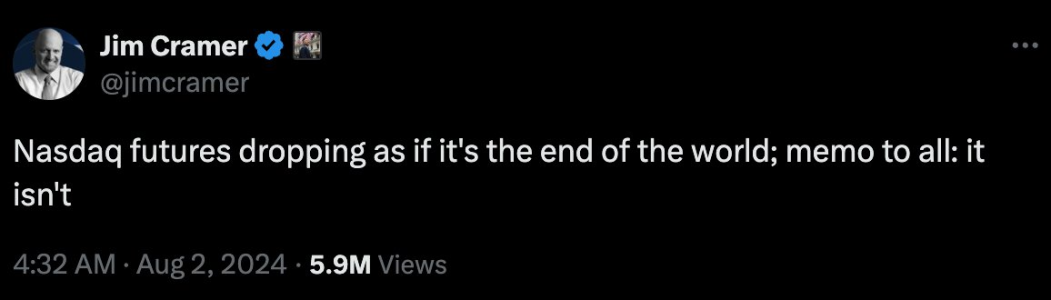

thinking we can see a flush toward 3274 in the s&p before we bounce and reset. Under there and we have 3225 and 3156.75. NASDAQ really needs to hold 10856 otherwise it could flush down to 10568, 10500. Would be good for the longer term trend to reset down there and resume grinding back. Painful short term, but that's life.

- 12,807

- 27,844

- Joined

- Aug 9, 2014

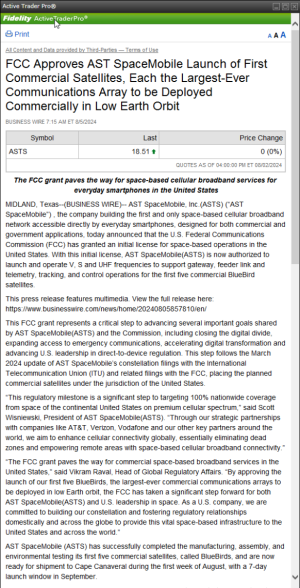

This tweet was clutch.

Can someone explain this to a rookie?

- 14,173

- 6,430

- Joined

- Feb 4, 2012

Why are we so excited about the TSLA and Apple stock split? I don't see it affecting the price much.

- 30,114

- 21,511

- Joined

- Dec 23, 2009

Robinhood.Why are we so excited about the TSLA and Apple stock split? I don't see it affecting the price much.

- 297

- 139

- Joined

- Sep 13, 2012

Yo guys, sorry for the rookie question here...just trying to gain more knowledge and turn this corner in an intelligent manner. With this Tesla 5-1 split, if someone has 1 stock will they receive an additional 4 at the end of close on Aug 28 (still totaling the overall value of what 1 stock was pre-split)? Appreciate yall!

- 30,114

- 21,511

- Joined

- Dec 23, 2009

Correct. 1 share turns into 5, the value of 5 shares is equivalent to what that 1 share was.Yo guys, sorry for the rookie question here...just trying to gain more knowledge and turn this corner in an intelligent manner. With this Tesla 5-1 split, if someone has 1 stock will they receive an additional 4 at the end of close on Aug 28 (still totaling the overall value of what 1 stock was pre-split)? Appreciate yall!

- 74,739

- 24,134

- Joined

- Apr 4, 2008

Someone decided to use options to hedge their portfolio in case the market goes lower. Dollar amount on index options is pretty meaningless. Just an institution taking a hedge. Expect short term volatility.Can someone explain this to a rookie?

- 3,602

- 2,238

- Joined

- Mar 14, 2014

Why are we so excited about the TSLA and Apple stock split? I don't see it affecting the price much.

My understanding is it increases the amount of shares available without dilution. Making it more accommodating for inclusion in sp500. Lower price makes it more accesible.

Yo guys, sorry for the rookie question here...just trying to gain more knowledge and turn this corner in an intelligent manner. With this Tesla 5-1 split, if someone has 1 stock will they receive an additional 4 at the end of close on Aug 28 (still totaling the overall value of what 1 stock was pre-split)? Appreciate yall!

yeap. Multiply shares by 5. Dividenstock price by 5.

- 16,092

- 16,835

- Joined

- Apr 16, 2005

Wrong thread lol

Last edited:

- 30,114

- 21,511

- Joined

- Dec 23, 2009

PG a *****. He dont want to see Dame in the playoffs again, might have to run away to another team if Dame sees him in another elimination game.

- 14,173

- 6,430

- Joined

- Feb 4, 2012

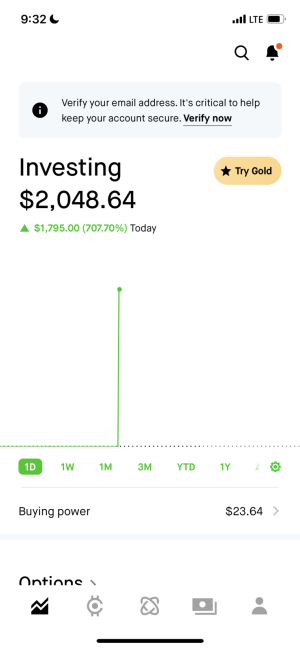

Robinhood.

The large majority of the shares are owned by institutional investors iirc.

But for sure it won’t hurt.

- 9,503

- 15,502

- Joined

- Jul 30, 2017

YepRobinhood.

After the split tesla will be back to $1000 or more within a year at max

- 57,647

- 61,217

- Joined

- Aug 6, 2012

Enough time to load up this time. Won’t make the same mistake twice.Yep

After the split tesla will be back to $1000 or more within a year at max

- 74,739

- 24,134

- Joined

- Apr 4, 2008

Just for reference, Apple at its peak only reached 460 after its split while buying back billions worth of stock. Tesla going back to a thousand isn’t something that’s happen easily, if at all.

- 26,501

- 29,711

- Joined

- Nov 3, 2011

wrong thread.

- 28,811

- 17,406

- Joined

- Mar 22, 2003

Haircut time love it

- 12,440

- 13,982

- Joined

- Jan 5, 2009

Still don’t get this ish man lol

crazy to understand even whenI try

crazy to understand even whenI try

- 35,214

- 26,870

- Joined

- Jul 13, 2005

Still don’t get this ish man lol

crazy to understand even whenI try

Start with some books. You'll have a much better understanding in about a month. There are a bunch others but these two stood out to me.

1. Random Walk Down Wallstreet by Burton

2. How to Make Money in Stocks by Oneal

- 30,114

- 21,511

- Joined

- Dec 23, 2009

Also set up a paper trading account. It's easier to learn lessons when you're not using your own money. But pay attention to what trades you're making and why. Also read about charting patterns and my personal favorite indicator, RSI.

- 6,874

- 4,751

- Joined

- Mar 14, 2011

How you set up one of those?

DeadsetAce

Supporter

- 106,522

- 52,664

- Joined

- May 31, 2004

Also read about charting patterns and my personal favorite indicator, RSI.

for active and short term traders: when the 5 day moving avg crosses above the 13 day moving avg...usually a good buy sign. my coworkers and i use this for stocks we're just looking to make a quick 10-20% return on and bail

- 74,739

- 24,134

- Joined

- Apr 4, 2008

Takes three years. Keep your size very small.Still don’t get this ish man lol

crazy to understand even whenI try

Similar threads

- Replies

- 22

- Views

- 2K

- Replies

- 1

- Views

- 1K