- 12,008

- 3,294

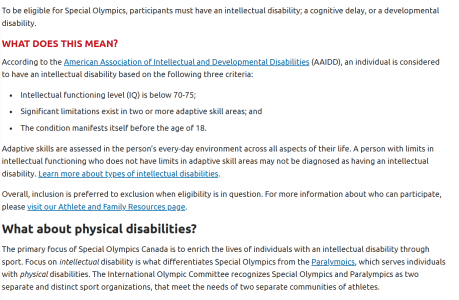

He is saying that the federal statute of limitations on tax penalties is generally three years. In some instances they can go back six years if there was a substantial understatement of tax (more than 25%). In the cases of civil fraud, the IRS does not have a statute limitations. Them still looking at 2009/2010 appears to show that there is something more than simple tax avoidance is going on and it has moved into tax evasion territory.

While he likely wont get arrested for it, it is still illegal and he will likely have to pay a substantial penalty and interest.

But, at this point, nothing is conclusive?

And, after further investigation, it might be determined that he acted legally?