The average American now needs to work 53 weeks to afford the $54,441 living costs of a family of four. There are 52 weeks in a year.

www.businessinsider.com

The typical US worker can no longer afford a family on a year's salary, showing the dire state of America's middle class

The median male US worker now has to earn over a year's salary to afford the annual expenses for a family of four,

according to The Cost of Thriving Index in a new report published by conservative think tank the Manhattan Institute and previously

reported by The Washington Post.

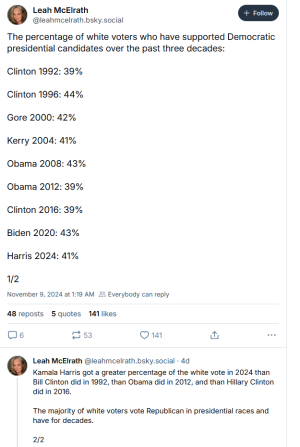

In 1985, the typical male worker needed 30 weeks' pay to afford the $13,227 required for a family of four's major living costs: housing, healthcare, transportation, and education. As of 2018, those expenditures had risen to $54,441, and our typical male has to work 53 weeks to get there (shown in the chart below). "This is a problem, as there are only 52 weeks in a year," wrote Oren Cass, the report's lead author.

The colored sections represent the four key living costs of middle class life for a family of four. Together, they add up to the total cost of thriving. The line shows the wages for a typical male worker. It's below the total cost of thriving, meaning the male worker's annual income isn't enough to cover all these costs. Andy Kiersz/Business Insider

The Index looked at data from the Bureau Labor of Statistics' estimates for the median usual weekly earnings of men older than age 25 who are employed full-time as wage and salary workers.

Cass formulated the Index on male earnings, as men are historically considered the family breadwinners. His findings for a female breadwinner are even more telling: In 1985, she needed to work 45 weeks to afford the four annual expenses, compared to 66 weeks in 2018.

The typical female worker has an even harder time than the typical male worker affording housing, healthcare, transportation, and college for a family of four. Andy Kiersz/Business Insider

Both sexes are below the total cost of thriving line in the above charts, as measured by the Manhattan Institute. This means a single-earner household is now impossible.

Living costs are outpacing wage increases

The Cost of Thriving Index points to tensions underlying the American economy, from the

gender pay gap to skyrocketing living costs that have outpaced wage increases, particularly for younger generations.

Those between ages 25 and 34 have only seen a

$29 income increase since 1974, when adjusted for inflation,

according to a new SuperMoney report that analyzed US Census Bureau data. Adults ages 35 to 44 made nearly $2,900 more in 2017 than their 1974 counterparts did, while those ages 45 to 54 saw an income growth of nearly $5,400 over that same time period, adjusted for inflation.

Meanwhile, college tuition has more than doubled since the 1970s, bringing national

student-loan debt to an all-time high of $1.5 trillion. According to

Student Loan Hero, the average student-loan debt for a student who took out loans and graduated in 2018 was a whopping $29,800.

The price of home sales has

increased by 39% since the 1970s and national health care costs per person have increased by $9,000 in the same time frame, according to the SuperMoney report.

The increase in so many disparate costs shows that the

middle class Americans are

carrying several financial burdens — they're behind on homeownership, lagging in retirement savings, and have debt to pay off, according to a previous INSIDER and

Morning Consult survey.

When all the paychecks from one year don't pay off a family's living costs, our typical male will feel he's living paycheck to paycheck, but it's actually worse than that.