The new director of the Federal Trade Commission’s consumer protection unit, a watchdog with broad investigative powers over private companies, stands out even in an administration prone to turning over regulatory authority to pro-industry players.

The director, Andrew M. Smith, has recently represented Facebook, Uber and Equifax — all companies with matters before the commission — and

plans to recuse himself from dozens of cases now that he has been confirmed for the post.

And in 2012, Mr. Smith was also part of the legal team that defended AMG Services, the payday lender founded by the convicted racketeer Scott Tucker, whose predatory practices against impoverished borrowers eventually led to a $1.3 billion court-ordered settlement, the biggest in the commission’s history.

“It’s outrageous the F.T.C. would pick the lawyer for a criminally convicted racketeer’s payday loan company as consumer protection chief,” said Senator Elizabeth Warren, Democrat of Massachusetts, who opposed Mr. Smith’s selection. “The agency should pick someone with a track record of protecting consumers, not companies that cheat people.”

Mr. Smith was confirmed by the commission on Wednesday, with the agency’s three Republican commissioners voting in favor of and the two Democratic commissioners voting against his appointment.

Rebecca Kelly Slaughter, a Democratic commissioner, said she voted against Mr. Smith because requiring him to step aside from the consumer protection bureau’s most high-profile investigations “undermines the public’s confidence in the commission’s ability to fulfill its mission.”

But the commission’s chairman, Joseph J. Simons, a Republican, said he was “disappointed that two of my new colleagues have chosen to turn Mr. Smith’s appointment into a source of unnecessary controversy.”

Mr. Smith, regarded as a hard-working and knowledgeable lawyer even by critics, worked as a lawyer for the commission in the early 2000s, drafting many of its regulations on credit reports and identity theft. In private practice for much of the last decade, he has represented industry groups, including payday lenders. He has also appeared before Congress to argue for loosening regulations and scaling back aggressive enforcement of existing laws.

Mr. Smith “has defended the worst of the worst,” said Karl Frisch, the executive director of Allied Progress, a progressive advocacy group based in Washington that opposed the appointment.

Mr. Smith, in an interview on Wednesday, pointed to his previous work at the commission and said he would continue the mission at the Bureau of Consumer Protection.

“I look forward to working with all the commissioners to do what’s best for consumers,” he said. “I obviously don’t think I’m disqualified because of prior client relationships. I have a long history of service to consumers, to the industry and the profession.”

As a lawyer with Covington & Burling, Mr. Smith has represented dozens of companies over the past two years, including many banks, lenders, credit-reporting agencies and technology companies, which will force him to recuse himself from any potential investigations or enforcements against those organizations, according to two people with knowledge of the situation.

But Mr. Smith’s work for AMG raised new questions about his fitness to run a division that polices payday lenders among many other industries accused of fleecing consumers.

In early 2012, the Federal Trade Commission filed a court case against AMG, arguing that the firm — a complex web of companies overseen by Mr. Tucker — had engaged in an array of deceptive and fraudulent business practices, including the illegal use of threats against borrowers who were unable to pay back high-interest loans.

Mr. Smith, then a lawyer with Morrison & Foerster, met with the agency’s lawyers and other defense counsel on at least one occasion, a group that included Mr. Tucker’s personal lawyer, Timothy Muir. Mr. Muir would later be charged and convicted of helping Mr. Tucker run what prosecutors described as a $3.5 billion criminal enterprise.

Mr. Smith said his work had been limited to advising his client, technically a company overseen by an Indian tribal council, on the commission law. He said the Morrison & Foerster team worked on the case for about six months.

In October 2016, a federal judge in Nevada hit AMG with a $1.3 billion settlement and held Mr. Tucker personally liable for setting up the complicated enterprise. In January, he was sentenced to over 16 years in federal prison “for operating a nationwide internet payday lending enterprise that systematically evaded state laws for more than 15 years in order to charge illegal interest rates as high as 1,000 percent on loans,” according to

a news release from the Justice Department. (Mr. Tucker had used his profits from the payday lending scheme to fund a side career as a racecar driver.)

Mr. Muir, his lawyer, received a seven-year sentence.

Mr. Smith declined to say whether he had spoken with Mr. Tucker, saying he was unsure whether answering would violate confidentiality agreements with his former clients.“And does it matter?” he said.

Asked whether he had second thoughts about representing companies that had helped Mr. Tucker bilk vulnerable people out of millions of dollars, he said: “I think all lawyers think about that. I was a part of a team at MoFo, and I think that everyone deserves a good defense.” He said the Native American firms he represented believed they were helping people.

Mr. Smith also declined to name other companies on his recusal list. He said many we re banks, and were thus typically not regulated by the Federal Trade Commission. He added that he would still stay busy at the agency because there were many companies that were not on his list. “It’s a big world and the F.T.C. has very broad jurisdiction,” he said.

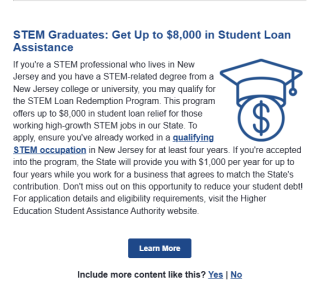

Mr. Smith’s selection comes at a time of drastic deregulation of financial services — especially enforcement of laws meant to protect poor people — led by Mick Mulvaney, the interim director of the Consumer Financial Protection Bureau. In recent weeks, Mr. Mulvaney has scaled back the bureau’s investigations into student loan abuses and payday lenders while calling for the elimination of an online database of complaints against banks.