- 37,331

- 32,155

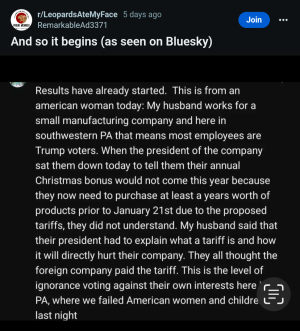

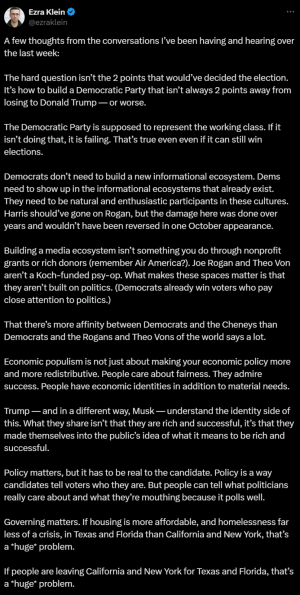

So I followed up with his reason why he was against this plan and he stated it was the principal of it. He questioned if it was fair to 'tax the rich'. And referenced a mutual friend that would fall under this category, if it was fair to him.This does a pretty good job explaining the nuances:

What We Know About Kamala Harris’s $5 Trillion Tax Plan So Far

The vice president supports the tax increases proposed by the Biden White House, according to her campaign.www.nytimes.com

At the very top of the article:

No one making less than $400,000 a year would see their taxes go up under the plan.

The proposal for your doctor is that after $1m, he pay ordinary income on his cap gains. It’s unclear to me if this is a trigger or if it’s marginal, but I have to assume the latter as the former would invite way too many shenanigans with tax optimization.

Then I asked, you aren't anyway near this proposed plan for it to affect you and your family and why are you worried about our friend's money lmao.

That followed by crickets.