- 44,803

- 66,511

- Joined

- Mar 24, 2001

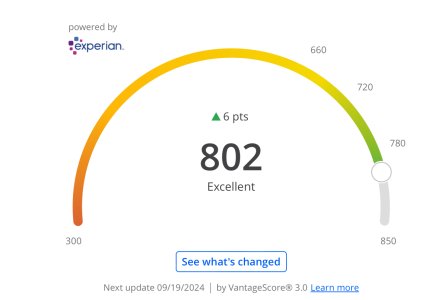

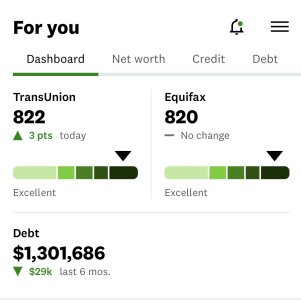

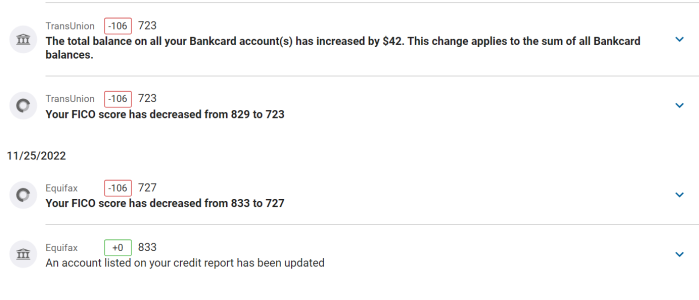

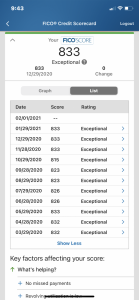

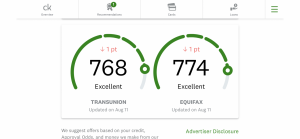

Got a bunch of **** removed from my credit report. Just disputed everything and my score went up like 50 points. Tryna get Verizon to take this pay for delete but they're being a-holes so I'm disputing them too. If I can get that dealt with my old discover account will fall off this year and my file will be squeaky clean.

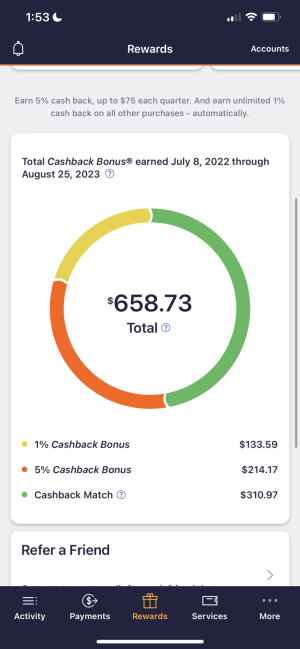

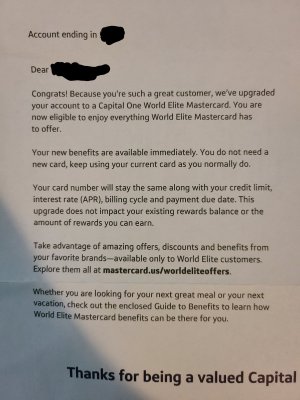

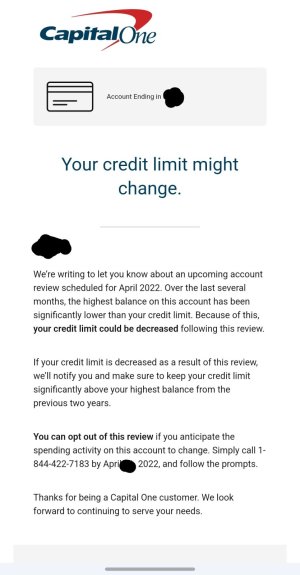

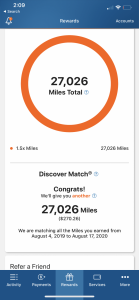

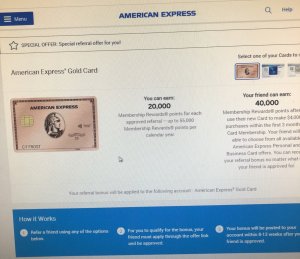

Re: credit cards. I signed up for that cap one secure card. Definitely going for that PayPal card once my score is up. After that it looks like discover it and chase sapphire are the best options for rewards? Is that the consensus in here?

Re: credit cards. I signed up for that cap one secure card. Definitely going for that PayPal card once my score is up. After that it looks like discover it and chase sapphire are the best options for rewards? Is that the consensus in here?

). Gonna stop using my bofa card when the 5% cash back on gas with discover starts. I'm trying to hit $500 by July

). Gonna stop using my bofa card when the 5% cash back on gas with discover starts. I'm trying to hit $500 by July