- 4,038

- 4,959

- Joined

- Apr 5, 2012

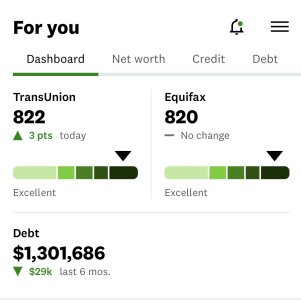

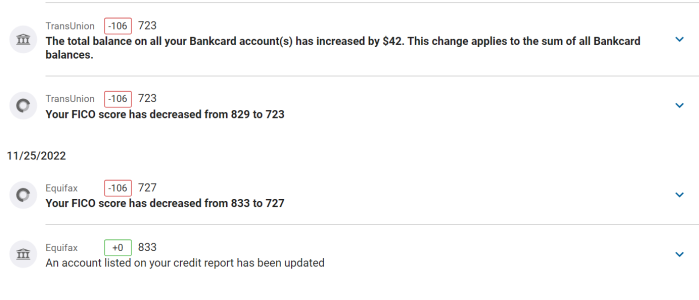

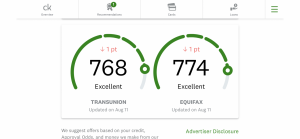

Just got the CreditKarma app. I was so pleasantly surprised by how good it is. Shows every account and the debt on it. My biggest fear is that one of my unused credit card accounts has fraud on it and I don't realize since I never use it/login to the online account/get paperless statements. This app is amazing.

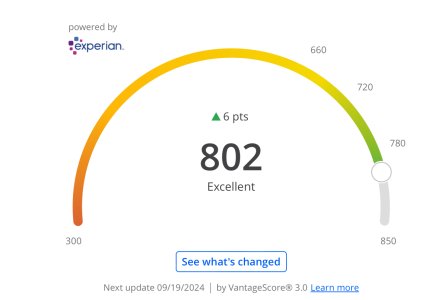

My stats:

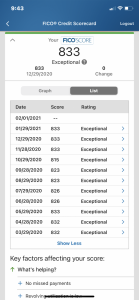

735

18% card utilization

100% payment history

5 years 2 months average age of history

32 total accounts

1 hard inquiry

Now my question is should I cancel old unused credit cards (wouldn't cancel my oldest ones of course). This would bring the average age up + will get credit limit increases on my current cards + pay off remaining debt? Aiming for that 780+ club

My stats:

735

18% card utilization

100% payment history

5 years 2 months average age of history

32 total accounts

1 hard inquiry

Now my question is should I cancel old unused credit cards (wouldn't cancel my oldest ones of course). This would bring the average age up + will get credit limit increases on my current cards + pay off remaining debt? Aiming for that 780+ club

Last edited: