antidope

Supporter

- 63,241

- 67,375

- Joined

- Jan 2, 2012

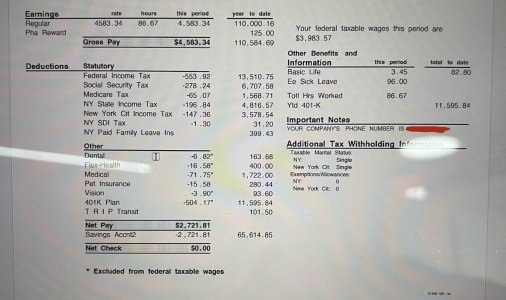

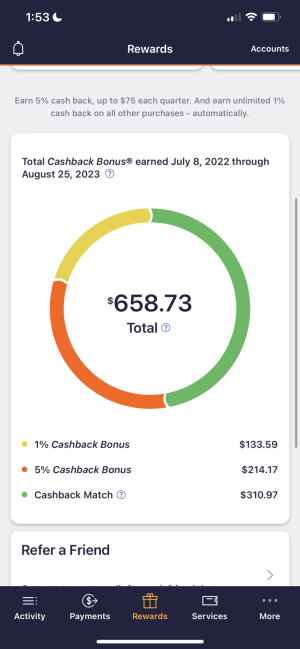

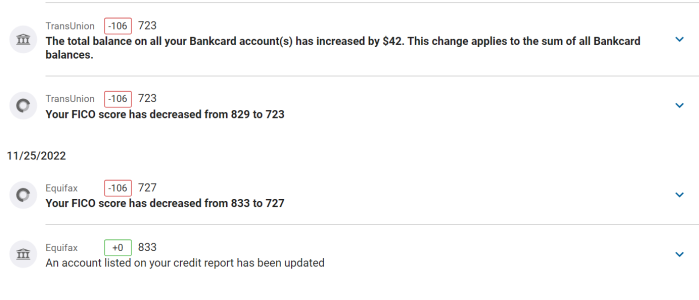

Excel spreadsheet. I keep track of everything I make and spend down to the penny.

It's more work for me to use Mint and make all the needed edits than to use my spreadsheet.

It's more work for me to use Mint and make all the needed edits than to use my spreadsheet.

Last edited: