- 2,071

- 723

- Joined

- Jan 8, 2005

Thanks guys. I’ve got some questions about a 529. If they get a full scholarship let’s say, what happens to that money? At the moment my intention was using a regular account so I can create some money for her either for college, an eventual down payment for a house, or some money for a wedding. If I do 529 is that tied up strictly for schooling? What are the tax benefits?

you pay 10% on capital gains if you don’t use the money for college. Also you don’t have to use the scholarship money for school. so you can just use the scholarship money for the wedding/house instead.

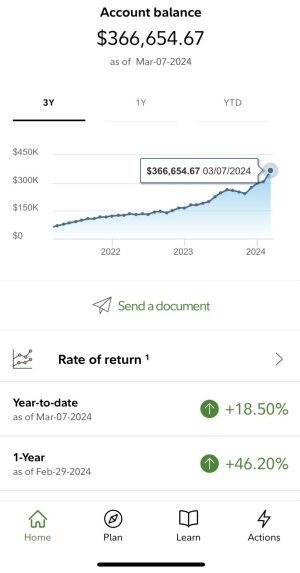

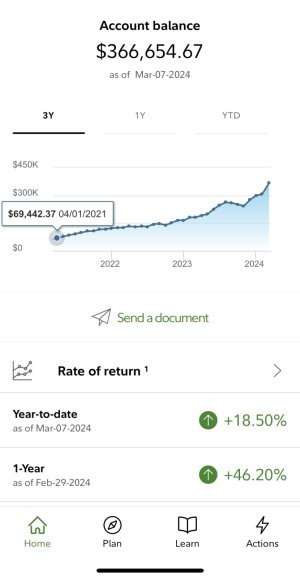

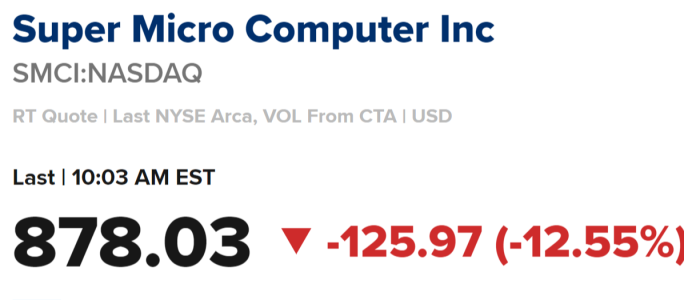

. But, I see a bounce back happening once this corona stuff blows over.

. But, I see a bounce back happening once this corona stuff blows over.