- 10,749

- 14,781

- Joined

- Aug 12, 2013

What are the most attractive dips you guys are buying up?

CURI

PENN

DKNG

ROCK

HNST

GAN

SQ

PINS

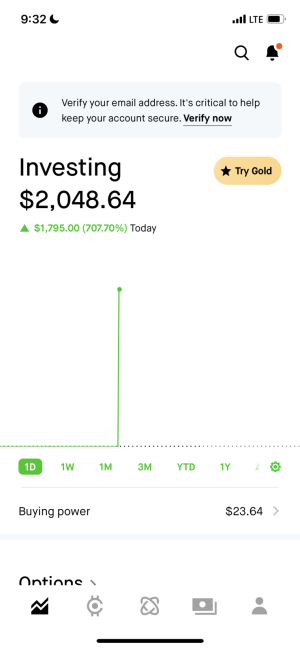

This is my entire portfolio right now. All I’ve been buying this month. In order by size too. Got $77k CURI at the top, $3k SQ at the bottom.

I’d avoid GAN since it has earnings soon. Gonna sell it before earnings for sure hopefully it goes up a little before then.

Might wanna avoid HNST too. I actually threw like $15k at HNST because an NTer mentioned it a few days ago. Didn’t do any DD. Then told my girl I bought it and she said it probably wasn’t a good idea since their products end up at Marshall’s on discount, which isn’t usually a good sign. But I dunno. It’s new and has dipped a lot since IPO. I’m down quite a bit on it lol.

I bought more CURI and SQ today. SQ under $200 is money. I didn’t listen to my own advice but I told myself a few weeks ago when I was 90% cash I wouldn’t buy any stocks until SQ got to under $200 again. That’s the buy the dip sign for me. But yeah I blew all my dip money before that point on stocks other than SQ. So bought some on margin today and depositing funds to get out of margin ASAP.

Last edited: