antidope

Supporter

- Jan 2, 2012

- 63,513

- 68,037

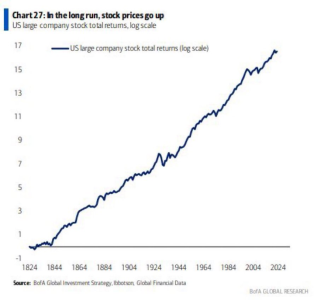

Yeah the tracking error on SPY is way tighter. VOO is cheaper though.VOO is a hold over from my first round of buys. Just didn’t want to sell it. Added SPY not too long ago and plan to add only to that. Looks like the better performer for S&P 500 ETFs.