- 74,729

- 24,118

- Joined

- Apr 4, 2008

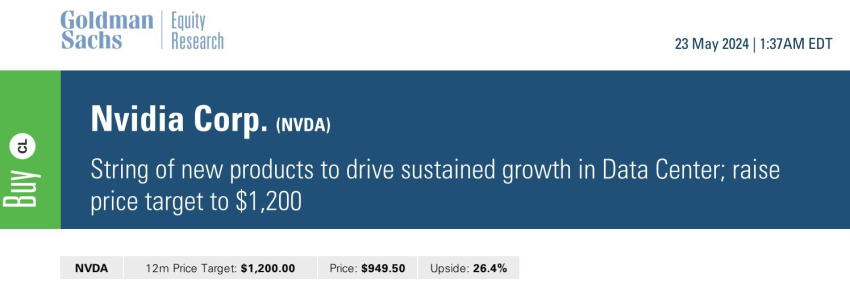

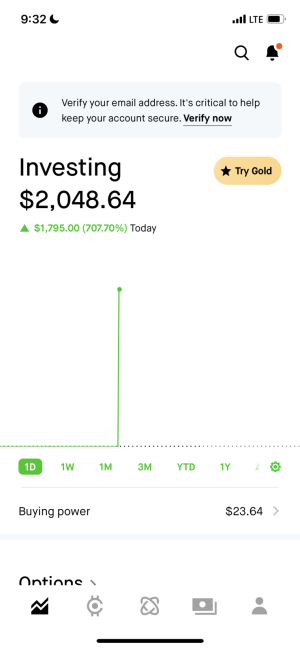

Think it would be a good buying opportunity if it gets beat up. Most of their revenue is from lending and Galileo.How these platforms make money is buying selling transaction data of its users to hedge funds. Said proposed legislation would stop that and thus take away revenue, not from just Robinhood, but other platforms that engage in the practice. IPOE is attached to Chamath who has a similar platform to Robinhood call SOFI Active investing that engages in the practice. This could cause IPOE and the like to drop.

.

.