- Apr 4, 2008

- 75,058

- 24,457

Experience

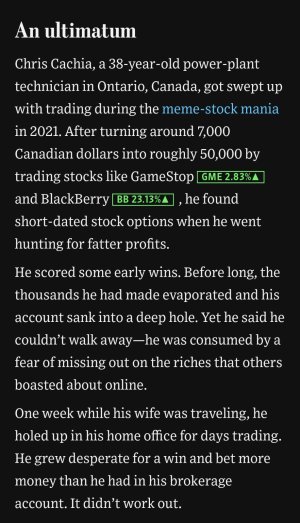

All honesty that's why it takes over a year to get consistent. Need to be submerged and quick to recognize what potentially could be a pattern with good risk-reward.

All honesty that's why it takes over a year to get consistent. Need to be submerged and quick to recognize what potentially could be a pattern with good risk-reward.