Hello ,

With the Spring equinox upon us, there is more than just warm weather around the corner.

The KOTM Q2 Platinum Open House begins Tue Apr 7 at 9 am EST, running for the length of each day’s market session until Fri Apr 10 at 4:30 pm EST.

Included with the FREE KOTM-exclusive Platinum Open House are SMS (text message) trade alerts. If you’d like to receive these for the week, please enter your mobile # on the registration page.

The KOTM-exclusive Q2 Open House

Tue 4/7 - Fri 4/10, 9 am - 4:30 pm EST

Click Here

https://attendee.gotowebinar.com/register/2927949252451453441 To Join The Open House

The live trading room is KOTM’s flagship product, and we’re constantly striving to improve this experience for our members.

We’ve recently brought on another new moderator, Christian Fromhertz, who served as the head of ETF Trading at Merrill Lynch.

Watch Professionals Trade for 6.5+ Hours Each Session!

The schedule for the live trading room is as follows:

8:30-930 am: Pre-market with Web Begole & Jim Ramelli

9:30 - 11 am: Andrew Keene’s Opening Bell (Unusual Options Activity)

11 am - 12 pm: Christian Fromhertz (ETF and ETF Options)

12 - 1 pm: Web Begole (Futures and Futures Options

1 - 3 pm: James Ramelli (Earnings, Equities, and Equity Options)

3 - 4 pm: Andrew Keene’s Closing Bell (Equities and Equity Options)

4 - 4:30 pm: After the Close with Web Begole

Click Here

https://attendee.gotowebinar.com/register/2927949252451453441 to Join the FREE KOTM-Exclusive Q2 Open House

Thanks,

Team KOTM

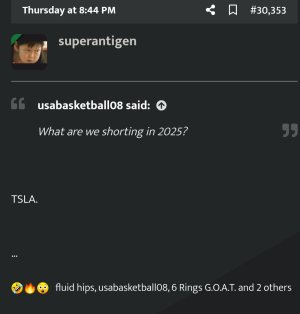

how is it down right now

how is it down right now

how is it down right now

how is it down right now

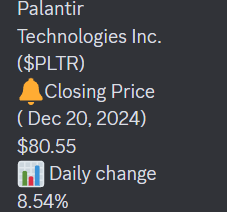

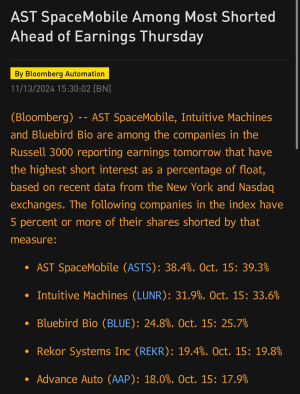

my 70-90-110 call fly looking decent. marking 3.75 from 2.90 entry. hopefully it doesn't go too bonkers before July expiration.

my 70-90-110 call fly looking decent. marking 3.75 from 2.90 entry. hopefully it doesn't go too bonkers before July expiration.