- Apr 4, 2008

- 75,052

- 24,453

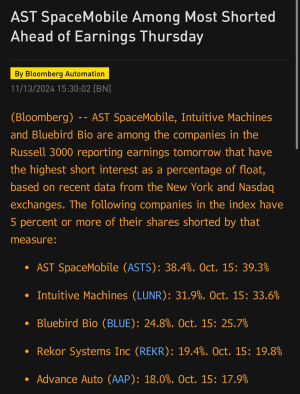

JCP the $9 straddle implies about a .90 move. JCP the past eight quarters is up 4 times with an average move of 11.89% and down 4 quarters with an average move of 9.15%. Implied move the past 8 quarters on average has been 14.28% and its actual move was 10.52% on average. This fiscal quarter the past two years has rallied once and sold off once with an average move of 20.32%.

9.96 is the top of value for the year so that'll probably be resistance if it gets a good report or spikes quickly.

Retail's tough right now. I'm long TGT for earnings with a 79-80 call spread expiring this week that I bought for .23 (4 lot), but that's only because of the demographic TGT has. Feel like although people aren't going to Macy's as much, or buying designer stuff like KORS, at least their getting there stuff at a more affordable retailer like TGT. Maybe the same can be said about JCP?

Good luck with your position either way.

9.96 is the top of value for the year so that'll probably be resistance if it gets a good report or spikes quickly.

Retail's tough right now. I'm long TGT for earnings with a 79-80 call spread expiring this week that I bought for .23 (4 lot), but that's only because of the demographic TGT has. Feel like although people aren't going to Macy's as much, or buying designer stuff like KORS, at least their getting there stuff at a more affordable retailer like TGT. Maybe the same can be said about JCP?

Good luck with your position either way.