- May 24, 2014

- 8,070

- 5,047

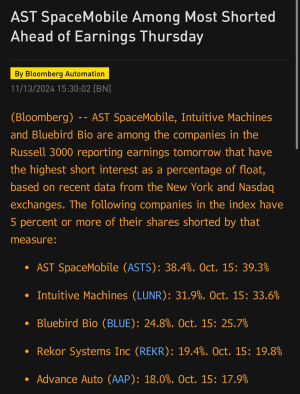

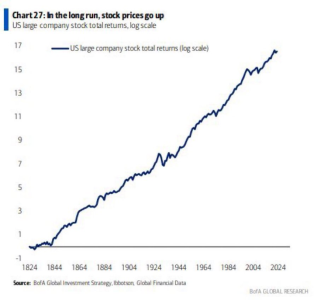

What's your guys' strategy for choosing a price level at which to enter a stock? I know its impossible to time the market, but generally what do you guys do in your efforts to nail an attractive entry? Currently want to add to my position in a few stocks since they're hot, but I don't want to get caught at the peak of a run up and get killed on a pullback.

Still did well today though. Wishing I had bought more TGT at $73.

Still did well today though. Wishing I had bought more TGT at $73.