- 26,812

- 38,423

2.8% isn't nothing but the tax cuts also blew a massive crater in the deficit. The pie in the sky promise of "trickle-down economics" has historically always failed in the US.I agree that wages are not growing as you would expect in this robust of an economy, but 2.8% growth isn't nothing ... The only way your argument works is if you accept the great economy talking point ... This is a classic liberal dilemma where they argue in circles and nothing ever seems to quite flow logically ...

Much like advocating for more government dependence in the midst of apparently the most racist administration in our history ... lol it never stops with the libbies ...

The economy is doing good of course, I don't think there's any debating that, but like many things you can't just look at something in a vaccuum.

The rough basis of trickle-down economics is that by drastically cutting taxes, folks will save a bit of money on their taxes and businesses will keep more of profits. And because of that, the rewards will trickle down from the top into the pockets of the workers and consumers. The tax cuts will pay for themselves due to accelerated growth. Like George H.W. Bush said, voodoo economics at its finest.

Wage growth in particular often plays a central role in the arguments for trickle-down economics. What is often not mentioned is that a vast amount of the increased corporate profits are simply spent on stock buybacks and bonuses for executives. Normally there will be at least some increased wage growth but again, you can't simply look at trickle-down economics' effect on wage growth or other aspects in a vaccuum.

The reason for that is that there are a number of other factors that also play key roles in assessing the impact of trickle-down economics on the average workers and consumers.

The most glaring factor obviously being the federal deficit. There's no getting around the fact that this will blow a gaping hole in the deficit and there is no way to get remotely close to recouping the drastic shrinking of federal revenue. "The tax cuts will pay for themselves" is a pie in the sky dream that has no basis in past history or reality in general, period.

Next, what comes hand in hand with massive deficit increases? Generally budget cuts and entitlement cuts. Whoever instituted trickle-down economics will now suddenly act surprised and outraged about the rapidly increasing deficit and push for entitlement cuts. Who is that going to hurt? The poor and the middle class of course, not the wealthy. Their corporate welfare will remain untouched.

That's one possible primary factor that could eat away at the financial benefits of trickle-down economics. There are a number of other key factors such as healthcare, inflation, trade policy, ... that could also have a major effect on those gains, even possibly eliminating those gains for some.

The question is not "how much more money am I getting from the tax cuts?", it is "how much money am I actually saving (or losing) when taking into account other factors that affect those financial aspects?"

Let's start with this example to illustrate why it is necessary to look beyond wage growth in a vaccuum. Inflation is just one example of a different factor that could eat away at those wage gains and/or savings on taxes.

https://www.wsj.com/articles/u-s-co...-at-fastest-annual-rate-since-2012-1531398709 (July 12)

Inflation Is Eating Away Worker Wage Gains

For the second month in a row, annual inflation fully offset workers’ average hourly wage growth

U.S. consumer prices rose for a third straight month in June, eating away at modest wage gains and sending inflation to its highest rate in more than six years.

The consumer-price index, which gauges what Americans pay for everything from veterinarian services to baby clothes, rose a seasonally adjusted 0.1% in June from the prior month, the Labor Department said Thursday. Excluding volatile food and energy components, prices increased 0.2%. Economists surveyed by The Wall Street Journal had expected a 0.2% uptick from May for both the overall index and so-called core inflation.

Last month’s price increases brought the CPI’s cumulative growth in June from a year earlier to 2.9%, the highest level since February 2012. Core inflation ticked up to 2.3% in June from a year earlier, the highest rate since January 2017.

For a second month in a row, annual inflation fully offset average hourly wage growth in June, leaving workers’ real hourly earnings flat from a year earlier despite falling unemployment and a generally strong economy. Production and nonsupervisory employees, a category which includes blue-collar workers, saw their real average hourly wages fall 0.2% in June from a year earlier after a similar slip in May.

“It’s the boiling-frog metaphor,” said Marc Hall, a 58-year-old communications specialist in Rockville, Md. “You notice it a little at a time, here and there, and then at the end of the year, you say, ‘Yeah, things went up a lot, didn’t they?’”

Mr. Hall said that while he received a 2% pay raise in the past year, he senses that his earnings haven’t kept up with the cost of living, adding, “It’s a net loss.”

While workers made up for higher prices by working slightly more hours per week, the stagnation of Americans’ purchasing power underscores questions about the extent to which workers are benefiting from an economy that by many other measures is booming.

Economists estimate gross domestic product grew in the second quarter at one of the fastest clips measured since the recession, while corporate tax cuts enacted at the end of 2017 likely fueled record earnings by publicly traded U.S. companies, analysts say.

“Wage growth remains surprisingly weak,” said David Kelly, chief global strategist at J.P. Morgan Asset Management, in a note to clients earlier this week. “The remarkable ability of firms to lure more workers back into the labor force and get stronger productivity gains from them without raising wages is a clear positive for profits.”

The year-over-year rise in prices was led by energy commodities, following a sharp rise in oil prices earlier this spring. The CPI report showed gasoline prices rising a seasonally adjusted 0.5% in June from May and 24% from a year earlier. Separate data from the U.S. Energy Information Administration showed the average price for a gallon of regular gasoline rose to $2.89 last month, the highest price for June since 2014.

Prices for other goods and services also increased.

Shelter and rent costs, which account for about a third of overall consumer spending, rose 0.1% in June from May and were up 3.4% from a year earlier. Medical-care services rose 0.5% from May and 2.5% from June 2017. And food prices rose 0.2% last month from May, though the annual increase in this category was more muted at 1.4%.

For many economists, accelerating inflation suggests the economy is behaving more or less as it should after years of fitful expansion that has brought the jobless rate near its lowest levels since the 1960s. A separate inflation measure favored by the Federal Reserve, the personal-consumption expenditures price index, rose in May to 2.3% from a year earlier, the highest annual rate in six years and 0.3 percentage point above the central bank’s target.

This has bolstered Fed officials’ case for gradually raising short-term interest rates to keep the economy from overheating. They have lifted rates twice this year and penciled in two more increases by year’s end.

At their most recent rate-setting meeting, in June,Fed “participants generally agreed that the economic expansion was progressing roughly as anticipated, with real economic activity expanding at a solid rate, labor market conditions continuing to strengthen, and inflation near the Committee’s objective,” according to meeting minutes released last week.

Economists said Thursday’s data generally supported their view that inflationary pressures are gradually picking up.

But a key question going forward is how far the Trump administration will take its escalating trade dispute with China. The White House, which imposed tariffs on $34 billion of Chinese exports of industrial goods like auto parts and electronic components, said this week it would assess 10% tariffs on an additional $200 billion in Chinese consumer goods.

The impact of those tariffs, should they take effect, won’t be negligible, economists say.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, said the goods subject to the proposed tariffs account for almost 6% of the core CPI, meaning that a 10% levy would lift the index by up to 0.6 percentage point.

“The Fed can’t stand back and ignore a hit of this size, given the tightness of the labor market,” Mr. Shepherdson said in a note to clients dated Thursday. “People will seek to be compensated for the squeeze on their real incomes as a result of higher prices, and their chance of being able to force employers to pay up is better now than at any time since the crash.”

We have now landed at healthcare, one of the most important and significant expenses for the American citizen. The US has significantly higher healthcare spending per capita than any other country, including those with full single payer universal healthcare systems. Whether it's a single payer system like in Canada or a multipayer system like in Belgium, those systems all operate at a lower cost than the US healthcare system, while at the same time providing many more benefits to many more people.

US health insurance premiums are skyhigh across the board, as are medical expenses in general. It is quite the financial burden, especially for the poor.

Fun fact: I recall that Trump has actually given high praise to the Scandinavian healthcare systems, I believe it was during a speech at Gettysburgh

Which brings to me to my point, healthcare expenses. This is something that also must be taken into account when examining the financial gains of trickle-down economics.

If someone were to 'sabotage' the existing healthcare system and insurance markets for example, that would lead to instability and further drive up premiums at an increased rate.

Kind of like what the Trump administration has been doing as they failed in their attempt to repeal the ACA. If you can't destroy it, fracture it.

The suspension of risk adjustment payments, slashing the CMS' funding of consumer enrollment assistance, the DOJ declining to defend key parts of the ACA, ...

Without any form of replacement for the ACA, disrupting the system and related markets through acts that could be described as sabotage will simply result in increased costs for consumers.

Premiums will rise either way but those actions, of which there are many, will only accelerate the rate of premium increases.

Those premiums were never negligible costs to begin with and the impact will be felt, as usual particularly by the poor.

We have now established 2 key factors that can eat away at wage growth and saving more money from taxes. Let's move on to a final key factor, one that is very much relevant at this time.

Lastly we have ended at trade policy. While normally this would probably be a pretty negligible factor, the current president believes trade wars are good and easy to win so there's that.

A trade war is bad for all involved parties, period. Everyone involved is going to take a financial hit, some more than others.

President Trump has taken a very aggressive approach, targeting allies and enemies alike. This has resulted in retaliatory tariffs against the US from various corners of the world.

China, the EU, Canada and Mexico have all fired back against the Trump administration with retaliatory tariffs. In large part those retaliatory tariffs seek to focus their impact on Trump supporter strongholds. Business sectors like farming have been a prime target for example. Business groups in various sectors have been protesting against Trump's unilateral trade war but the president has shown no signs of slowing down. Since the initial round of tariffs he has mostly further escalated the administration's approach on tariffs.

The administration is even pushing forward a multi-billion dollar welfare package for the farmers who have been hurt by the trade war Trump started. However farmers and other business sectors will continue to take financial hits from the continuation of the trade war, particularly if it escalates further. A welfare bandaid is just that, a bandaid.

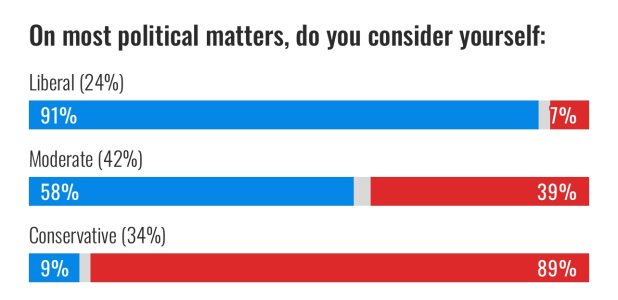

The most significant retaliatory tariffs came from China. Here is a graphic example that illustrates how its impact is rippling through America. (Source: WSJ)

Trump supporters undoubtedly love the look of Trump's electoral victory map but their wallets won't be very pleased with all the red on this map.

Note that this graphic only assesses the impact of China's retaliatory tariffs. The impact of the other countries' retaliatory tariffs must also be taken into account.

On top of that, the Trump administration is looking into both tariffs on auto imports as well as ramping up tariffs on Chinese goods to up to $200b worth of Chinese goods.

China announced a plan today to retaliate with tariffs on an additional $60 billion of US goods if the Trump administration further escalates tariffs against China.

https://www.wsj.com/articles/china-reins-in-yuans-rapid-depreciation-1533298628?mod=hp_lead_pos2

China Threatens to Impose Tariffs on $60 Billion of U.S. Products

Beijing also moves to rein in the yuan’s rapid depreciation

Trump and his economic advisers brushed off the threat and show no signs of slowing down. Additional escalation of the trade war will only further increase the economic impact on the US.

The trade war will continue to negatively impact various business sectors and drive up consumer prices of a variety of products targeted by tariffs.

To summarize, 3 key factors have been laid out that could and are already eating away at wage growth and tax savings. Healthcare, trade policy and inflation.

There are many outside factors that can affect an individual's finances of course, the aforementioned are simply a few rather obvious examples. Budget cuts and entitlement cuts that tend to go hand in hand with trickle-down economics could also chip away at those gains.

Let's not forget that the US median household income is around $57k (source: US census bureau 2016 survey)

So how much is the average American really gaining from wage growth and/or tax savings resulting from the trickle-down tax cuts?

More importantly, to what extent do other factors eat away at those gains? Perhaps nullifying them entirely for some.

On a final note, there is of course also the aftermath of trickle-down economics. As mentioned earlier, Reagan ushered in strong short-term growth but as a secondary result of the tax cuts, the deficit was also spiralling way out of control. It was then up to H.W. Bush to clean up the mess left by what he described as "voodoo economics". Thus he was forced to raise taxes back up again.

In fact, Reagan's first budget director has also echoed a similar sentiment, describing the concept of trickle-down economics as "dead wrong."

I don't think a history recap of the younger Bush's tenure is necessary. His tax cuts were part of the same branch of voodoo economics his father once stood firmly against and on top of that you had the wars and the economic crisis.

Last edited: