- 34,115

- 29,457

I agree that there should be a more thoughtful analysis before crying “invalid”, but I also think that Thiel’s presence in a politically related activity should invite more of that thoughtful analysis than his involvement in PayPal. I stopped reading Murdoch publications years ago because it just got too tiring to try to identify, isolate, and ignore the way editorial bias wormed it’s way in so i understand the temptation to throw out all things Thiel.

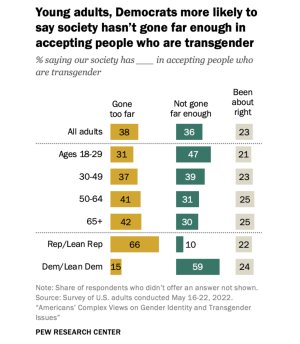

Anyways, I think the relevant part of his criticism wasn’t the Thiel bit, but rather that the punters skew right. If true, this is a pretty significant source of bias that should probably be dealt with if you want to escalate the data point “markets moved like blah” into some relevant piece of information. To be fair, triangulating against a separate market is a good first step in dealing with it.

Silver “advising” the platform and publishing what is essentially investment newsletters vis a vis this market is a questionable look. Usually the standard for these things in mature markets is impropriety or the appearance of impropriety. That said, I’m not sure where the money is here in market manipulation unless these guys are on the other side of trades which itself would be far, far more problematic.

Osh, do you happen to know if there’s any regulatory framework for the prediction markets?

The markets are all offshore so im sure there is zero regulation.

but again just think about this logically, let's say he's manipulating the market somehow for political purposes.

wouldn't that be incredibly easy to sniff out? and doesn't that create really obvious arbitrage opportunities that would bankrupt this entire venture?

remember there are multiple, prediction markets.

and to what end, the people who follow these markets are political junkies, and degenerate gamblers what is the point of bumping trump or fading Kamala, what does that do to help or hurt either candidate?

my point is saying "PETER THIEL FUNDED" isn't enough for me to care, you at least have to have some theory of the case.

also

all the people who accuse Nate Silver of bias inevitably end up looking stupid.

They were mad at him when he said Biden was cooked early.

They are mad at him when he said Kamala's post convention polls were weak.

in the end it's his accuser who always end up looking hopelessly biased.