- Apr 8, 2009

- 12,695

- 12,061

To get on the parachains, projects need $. To get $ they do crowd loans. To get crowd loans they give their tokens at a premium discount for help getting in.

Find the project(s) you like that’ll participate in auctions, help them with crowd loan funding, flourish.

I staked my Dot on kraken (12%), I’m just gonna leave it there. Dot accomplishing what it wants to is still a dream.. long term investment for me, but has SOL potential price wise, FOMO hedge

i am concerned about the global market/economy, everyone need to fire up the $ printer

Just to add to this, the DOT or KSM that you lend a project to get a parachain slot will be returned back to you at the end of the lease for that parachain.

So for example all those who lent their KSM for 48 weeks for Moonriver will get that KSM back so it was essentially free and Moonriver has exploded in price.

Parachains will be coming to DOT but the lease for DOT is a longer range. The max is 2 years but you will get your DOT back at the end of that period.

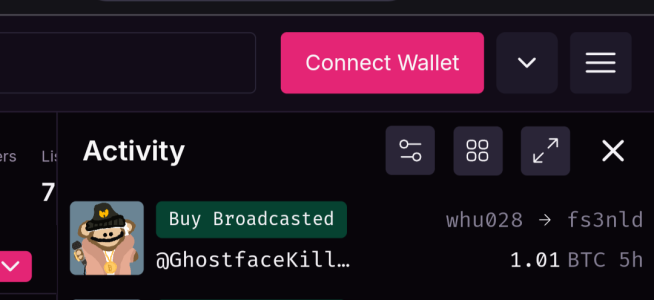

Here's a wallet of a whale who lent out about 3000 KSM for Parachain loan offerings. He's got close to 1 million in coins for free and he will get all that KSM back once the loan is over.

Sub ID: Substrate Addresses, Balances, Crowdloans and NFTs

Wallet info for your favorite Dotsama cryptocurrencies like Polkadot ($DOT), Kusama ($KSM), Acala ($ACA), Karura ($KAR), Moonbeam ($GLMR), Shiden ($SDN), Subsocial ($SUB), and other chains in the ecosystem.

sub.id

Also because you're loaning our your DOT or KSM, you won't have the regulation bodies coming after you like they did with ICO's

As more parachains join the main chain, more and more DOT/KSM will be locked up as well as those that are staked which will decrease supply and increase demand.

Parachains are essentially separate L1 chains but they are all specialised. They connect to the main chain, Polkadot or KSM. That way they share the validators and security of the main chain. The main chain also allows these connected parachains to speak to each other.

A chain specialised in Defi can speak to a chain specialised in NFT's. So you could for example use your NFT from another parachain as collateral to take out a loan in a DeFi Parachain.

Some chains also will have bridges to other blockchains like Ethereum and Solana allowing for interoperability not only between parachains but other chains too.

I didn't join any parachain loan offerings on Kusama. I wanted to see how it will play out but I will on Polkadot.

I'll try and go for Acala, Astar Network and Moonbeam. 2 years is a long time to lock up some DOT but I expect it to be 3 digits by then and I expect those 3 projects to moon as well.

Kusama already has 5 parachains conencted and 5 more ready to bolt on as well so everything is looking smooth so far. Just need to wait for DOT to announce its parachains and watch the price sky rocket.

. I missed out on the Snatchers

. I missed out on the Snatchers  . I'll probably grab one on Solanart but I'm waiting on the attribute chart to see what I like. Looks like floor has settled just above mint so far.

. I'll probably grab one on Solanart but I'm waiting on the attribute chart to see what I like. Looks like floor has settled just above mint so far.