- Aug 6, 2012

- 58,241

- 62,312

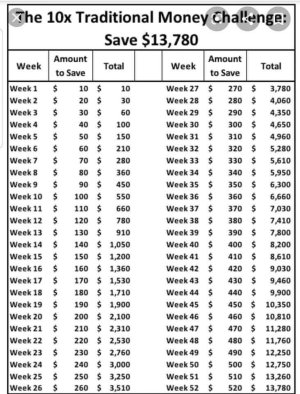

Congratulations to everyone who made their 2019 savings goals. Here we are with a new thread for the New Year, with new savings

This is the classic 52 week challenge. At the end of the year, with this you will have saved $1378

$2500 Challenge

$5000 Challenge

$7000 Challenge

$10,000 Challenge

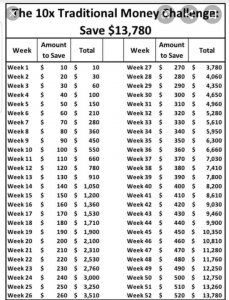

This is the classic 52 week challenge. At the end of the year, with this you will have saved $1378

$2500 Challenge

$5000 Challenge

$7000 Challenge

$10,000 Challenge

Last edited: