- Aug 20, 2003

- 14,363

- 3,028

Chase Freedom benefits are pretty cool. I strive to only use my card on things I would pay cash for, bills, groceries, and fast food etc.

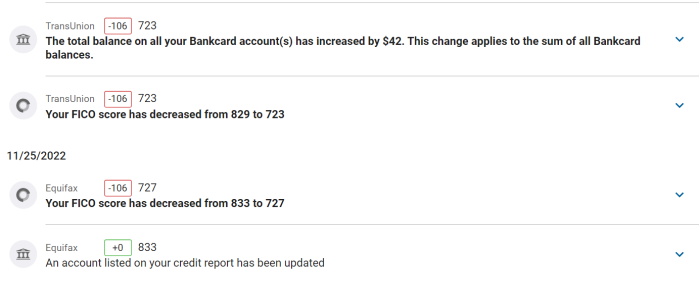

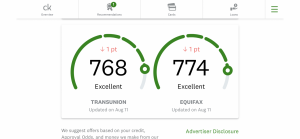

I try to pay it all off right away as soon as I get paid. rinse & repeat. I've seen my credit score jump. especially when I don't keep a balance or less than 25%. If I'm at the limit tho say after a big trip I definitely see a dip.

all in all though I get about $30-$50 cash back each month just for using the card the way I described before. Spend smart this year guys! try to be the only one in January with good $

I try to pay it all off right away as soon as I get paid. rinse & repeat. I've seen my credit score jump. especially when I don't keep a balance or less than 25%. If I'm at the limit tho say after a big trip I definitely see a dip.

all in all though I get about $30-$50 cash back each month just for using the card the way I described before. Spend smart this year guys! try to be the only one in January with good $

Last edited: