- Jun 1, 2011

- 863

- 114

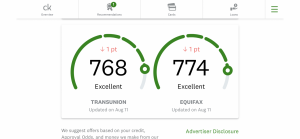

Rebuilding my credit now; used to have a high 700 score...but then the depression hit the economy and suffered greatly....slowly but surely getting negative stuff off my history, and rebuilding it

Last edited:

.

.