- 2,712

- 2,268

- Joined

- May 13, 2013

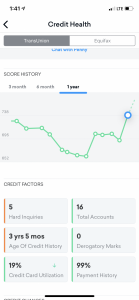

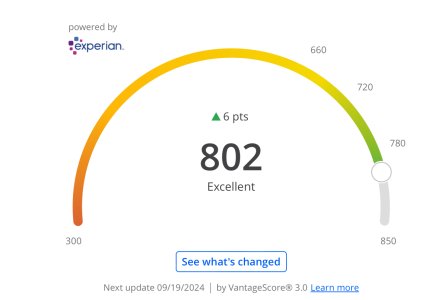

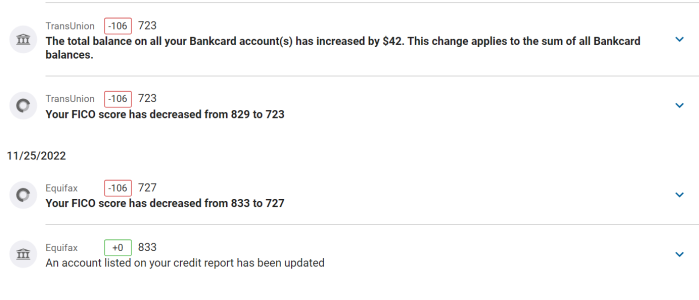

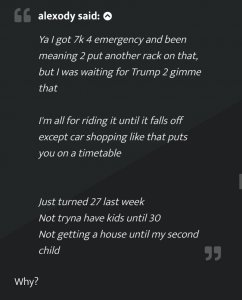

best credit card for travel perks with average credit?

Don't think id get approved for the Chase sapphire due to bad banking history with them in the past.

Don't think id get approved for the Chase sapphire due to bad banking history with them in the past.

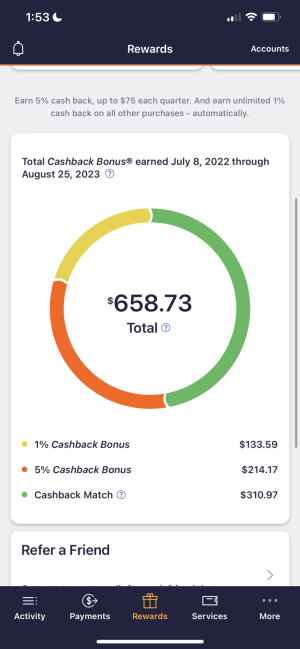

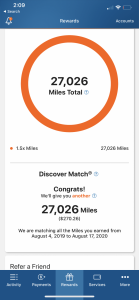

especially compared to like BofA or discover

especially compared to like BofA or discover