- 9,092

- 7,285

- Joined

- Aug 30, 2008

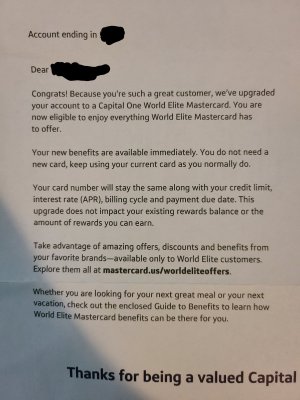

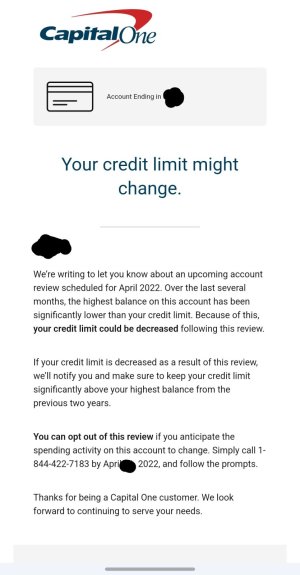

I'd pay off those 2 (Chase / CapOne) immediately if you can, especially since the CapOne is the highest interest rate.

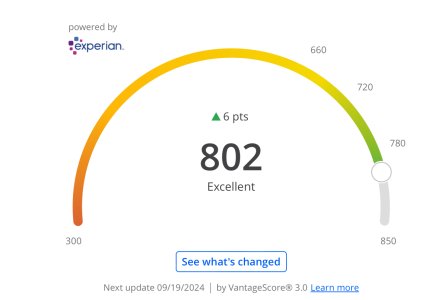

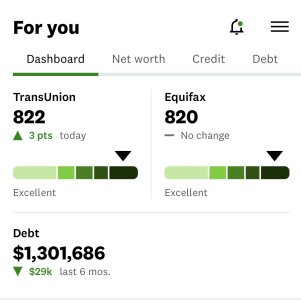

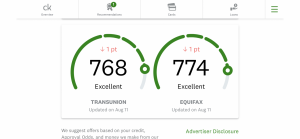

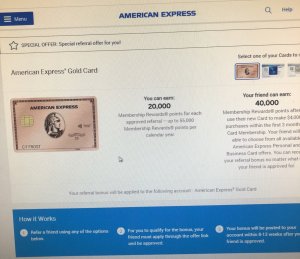

What is your credit score? Do you think you could apply for a Chase Slate card with 0% for 15 months? Balance transfer as much as you can to the Slate, while you pay off whatever you have left on the Amex / Discover cards.

Something else to consider - what are your other bills? Can you reduce spending in other areas, to focus on paying down the debt? Get a cheaper cell phone plan, eliminate/reduce cable TV, etc. ?

Repped

No doubt

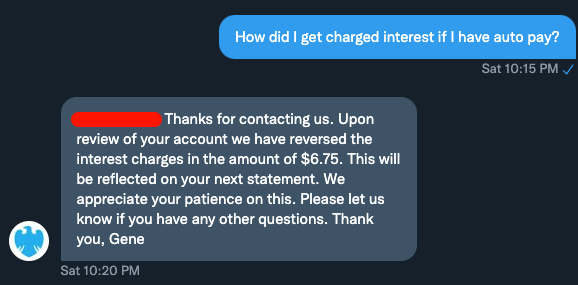

Chase slate is the one I have

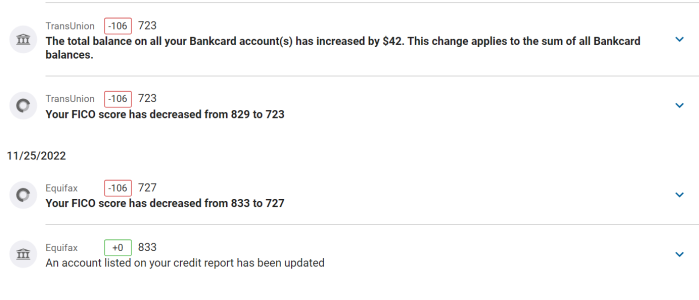

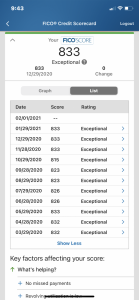

670 credit score, probably will drop after that waste of a hit from SoFi

I can probably cut cable, but that'll only save me $10 -15considering I would need to keep wifi

**** Verizon fios

**** Verizon fios

Last edited: