- 2,291

- 1,113

- Joined

- May 17, 2006

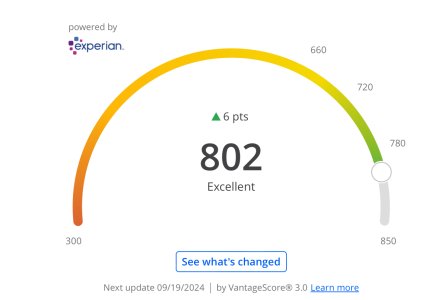

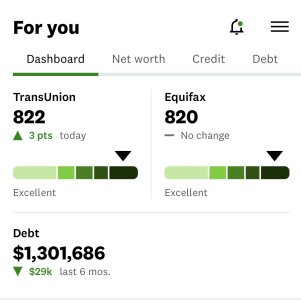

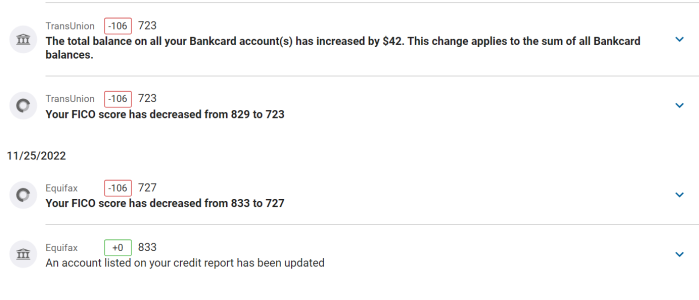

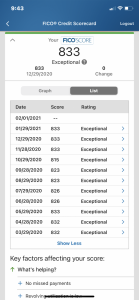

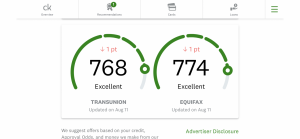

My credit dropped a little once I paid my car off. Took about a month to see it on my reports tho.

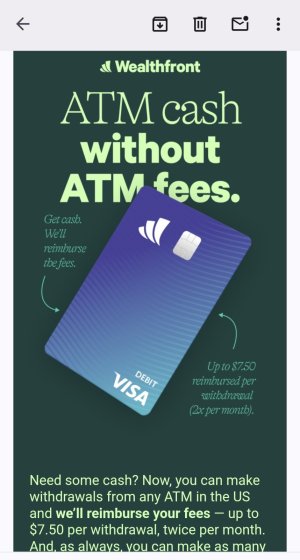

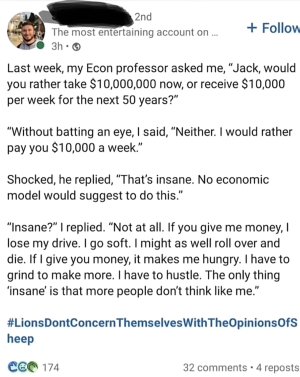

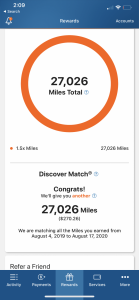

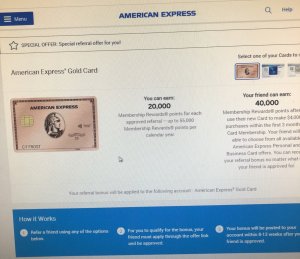

Since we don't have a personal finance thread, I'll post here. I'm looking to get involved with investing. Plan to start off with something small like Acorns (or a similar app) for now. Any suggestions on getting started? Also looking for referral codes if you guys have them. Might as well benefit each other.

Great idea; I'm interested in this as well!