Wow, I'm making SERIOUS bank with my Nasdaq shorts, so glad I sold everything off, I had a very strong feeling this was coming. Pretty much timed it perfectly.

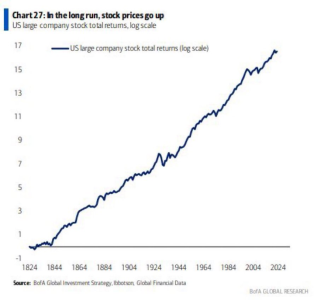

Rate cut done, QT done, unemployment at all time lows, consumer confidence at all time highs, earnings almost all "beat" estimates across the board, what's left to carry this market higher ? August - October is historically very dangerous and volatile. China trade deal was obviously not coming. Global economic data continuously deteriorating almost across the board, bond yields screaming danger, "Experts" on CNBC saying nothing but "buy buy buy".