- Aug 5, 2007

- 16,547

- 21,145

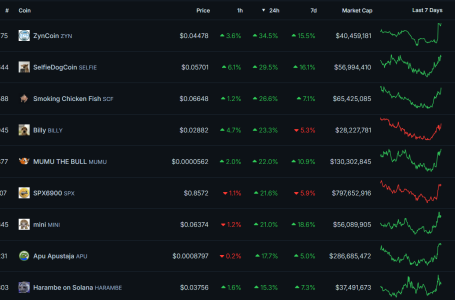

anyone ever open their metamask and only the ETH loads up? i thought i was hacked and almost **** my pants. the only ETH in my wallet is gas money. looked closely and the coins were showing but the total value didn’t calculate until i closed and reopened.