antidope

Supporter

- 62,987

- 66,770

- Joined

- Jan 2, 2012

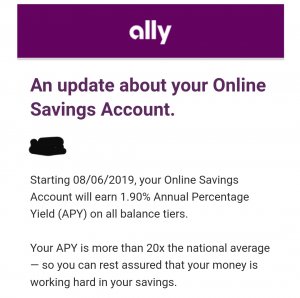

Sheesh that's wild. What is the yield above 10k though?Best interest rate I've seen is at Santander bank. 1.20% interest rate if you keep the balance above 10k, 0.30% if it drops below that.

Great Lakes Credit Union offers 3.0% on up to $10k

https://www.glcu.org/accounts/personal/checking/ultimate-checking/

Have to do some things (like use your debit card 10x per month, but you can buy 1 pack of gum in 10 different purchases) but its better than most

I don't ever use my debit card, it's been years. I use my credit card and pay it off in full every month but this is something I'd consider for a piece.