- Apr 16, 2005

- 16,134

- 16,913

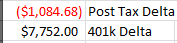

Companies do that in hopes to not give you money. My job is fully vested from day one, but the 5% matching is at the end of the year. So if you quit before the end of the year, they don’t owe you a contribution.

Lol kinda remind me of the open PTO policy that some companies love to brag about

It's not really open PTO & they only do that so they don't have to pay out vacation days if one leaves

Last edited: