- Mar 27, 2005

- 3,223

- 2,309

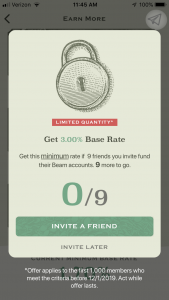

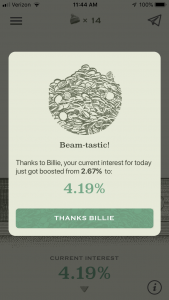

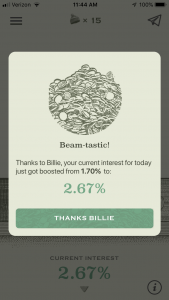

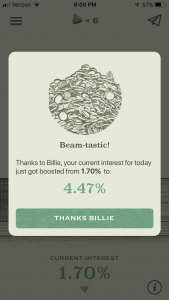

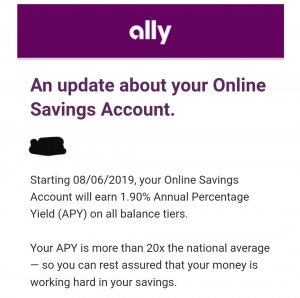

Any suggestions on what type of interest-bearing account to park $200k for the next 6 months to a year? A simple savings account would suffice? I would like to have access to it immediately without a penalty. Would like to hear NT's finance minds thoughts. Much appreciated!

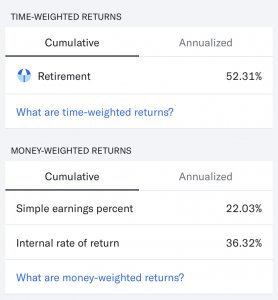

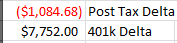

. I ended up saving 53.7% of what I made ..I really should be saving like 60-65%

. I ended up saving 53.7% of what I made ..I really should be saving like 60-65%