NBA fans will soon watch the sport differently, and change has already begun

About a decade ago, as the NBA prepared to negotiate its current 2016 television broadcast rights deal, the league had discussions with Fox Sports about adding a third TV package to its inventory, according to sources briefed on those conversations.

The NBA was already in business with ESPN and Turner Sports, and the two companies wanted to keep the league’s rights in place; Fox was interested in siphoning off games from its regional sports networks to create another national TV deal for the league.

That attempt was soon quashed by Turner and ESPN executives once they heard about them. When the NBA agreed to a deal in 2014, its games remained on the air of its two longtime partners.

Those contracts, worth $24 billion over nine years, are set to run out after the 2024-25 season, and now that the NBA has finished off its next collective bargaining agreement, it can move on to its highly anticipated media rights deal. Its size is already a point of discussion around the league, with its downstream effects set to have an impact on basketball revenue and the salary cap for years to come.

It seems nearly certain there will be changes for NBA fans in how they watch the sport, based on conversations with sources within the media industry and those with knowledge of the league’s thinking, who like others in this story were given anonymity so they could speak freely. The NBA seems likely to no longer constrain itself to mostly linear television in its national and local broadcasts, or to just ESPN, ABC and TNT.

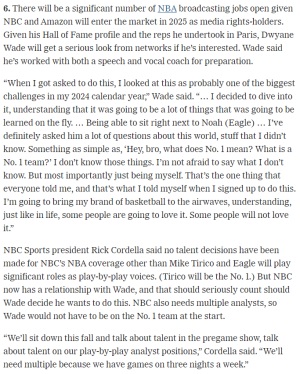

Commissioner Adam Silver has not been shy about his bullishness.

“I was the belle of the ball,” Silver said at a league event in Las Vegas last summer after he attended a media conference. “People want our programming. They couldn’t be more interested in it.”

The NBA has not yet begun official talks on its next rights contracts. The exclusive negotiating window with Disney, ESPN’s parent company, and Warner Bros. Discovery, the new mothership for Turner Sports, begins March 9, 2024, and is open for 45 days. After that, the league can test the market if there is no deal.

There is already plenty of speculation about what the end game may look like.

Cord cutting has changed the economics of cable television. Turner Sports is under new leadership and under the banner of a different corporation altogether since the last media rights deal was agreed upon. Disney and Warner Bros. Discovery have been public in their desire to keep costs down as they move forward, both trying to keep shareholders and Wall Street placated as they weather tougher times. The league must also find a way to get through the implosion of the regional sports networks that have been the backbone of its local team broadcasts.

During its last negotiations, the NBA maintained its status quo and stayed with ESPN and Turner as the two networks fended off any newcomers. The expectations now are that, even if they again retain NBA packages, at least one other company will grab a portion of the league’s rights.

The league has lined up its media rights contracts to afford itself maximum flexibility. No deal, domestically or globally, goes beyond the 2024-25 season. That allows the NBA a chance to create a new paradigm if it so chooses. The next deal will include some kind of streaming component, though it is still unclear in what form that will take and where.

Though the negotiating window has yet to open, the NBA has already received interest. NBC Sports has shown interest in bringing the NBA back to the network, a person with knowledge of the talks confirmed. CNBC was the first to report the news. NBC has even proffered to bring back “Roundball Rock,” the famed John Tesh opus if it were to get NBA rights.

Streaming networks like Amazon and Apple have been presumed to have interest. Both have increased their footprint in sports broadcasting over the last few years. Amazon now airs NFL Thursday night games and 20 Yankees games, while Apple TV+ consolidated the rights for the MLS and also airs two “Friday Night Baseball” games weekly. The NBA also could consider incumbent options for its streaming packages, like ESPN+ or Max from Warner Bros. Discovery.

“We’re all watching the MLS deal really close,” an NBA team president said. “They just leaned so heavily.”

The NBA’s new media landscape is likely to also auger more trouble for cable. The league has intentions of being on broadcast television more frequently in its next deal and less so on cable, according to a source with knowledge of the league’s thinking. That could reorient its relationships with Turner, which, unlike Disney with ABC, does not also own a broadcast channel. This past season, the NBA had 20 regular-season games on ABC, including its five Christmas Day games. That would be part of the league’s attempt to make itself more accessible to its viewers, especially as cord-cutting continues and the sheer number of cable subscribers falls off.

That would mirror the approach the league is pushing toward with local broadcasts. With Diamond Sports filing for bankruptcy in March, impacting its RSN deals with 16 NBA teams, and the tumult with Warner Bros. Discovery’s RSNs this season, cable television is increasingly an uncertain place for the NBA teams to air the majority of their games.

MSG Networks, which airs the Knicks, and YES Network, which airs the Nets, have already announced direct-to-consumer offerings where fans can buy monthly or annual subscriptions. The Clippers launched ClipperVision this season so fans could watch Clippers games outside of just the Bally Sports channel in their market.

The Suns announced last week they would move their games off Bally Sports next season to a combination of local free television and a direct-to-consumer streaming option with the intent to maximize the potential universe of viewers. A Jazz executive told The Athletic the team intends to move to a hybrid broadcast model next season.

“When I came into the league in the ’90s, there was a lot more local broadcast exposure, and now what we’re seeing is a lot of those broadcast stations in our teams’ local markets are coming back to the table and expressing interest in once again broadcasting our games,” Silver said recently. “That’s terrific news because obviously (we have) broad reach in those markets too if you’re on over-the-air television.”

The league has already started making preparations for this shift. It sought a new CBA now, instead of leaving the current agreement in place for the 2023-24 season, in part because it wanted to make changes in its media ecosystem and adjust to how the landscape has changed since the last CBA was signed in 2017.

And the newest CBA will try to deal with this issue. According to sources briefed on details of the negotiations, it includes language detailing how the cost of new direct-to-consumer products will be shared by the league and its players’ union.

Such moves could hit each franchise differently. The value of local broadcast rights is not equal across the board. One NBA team president told The Athletic the rights fees for the largest markets could be five to six times more lucrative than for teams in the smallest markets.

Most media experts agree that a shift away from the cable bundle and RSNs also would come with a decrease in revenue from local media rights, a trade-off that teams may need or want to make to prioritize access to its games for fans.

“There’s no doubt that, politely, we need to reimagine these relationships,” Silver said last month at the SBJ World Congress of Sports conference.

The NBA also has considered a nationwide local streaming service, according to sources. It has already approached franchises about help with their DTC platforms. The economics of such a service would have to be figured out, not only in the differences of how teams are paid out but also whether fans in different local markets would be charged.

After putting together a 100-person digital team for its NBA app and creating alternate feeds, there are plans to invest in an R&D group as well. There has been consideration about using the NBA app as a universal home for games, where viewers could find the games there and then be redirected to whichever TV partners are broadcasting them with the NBA paying out the rights holders.

Along with the ultimate destination for the games, there is plenty of speculation about how much revenue the next media rights deals could bring to the NBA. These have been boom times in recent years for live sports rights. Two years ago, the NFL sold its rights for more than $100 billion over 11 years, not including its Sunday Ticket — almost doubling its national TV revenue. The Big Ten Conference will get more than $8 billion over seven years. The NHL was able to more than double its annual rights fees in its 2021 deals with ESPN and Turner Sports.

However, Disney and Warner Bros. Discovery leaders have been circumspect this year about their spending plans.

“We’ve locked in a number of deals already, including some of the biggest ones, which is in college football with the SEC as well as with the NFL. The one that’s looming is the NBA,” Disney CEO Bob Iger said during an earnings call in February. “I know that’s on people’s minds, which is a product that we’ve enjoyed having and hope to continue to enjoy having. Because of not only its volume but its quality.

“ESPN has been selective in the rights that they bought. I’ve had long conversations about this with Jimmy Pitaro, and we’ve got some decisions that we have to make coming up, not on something — not on anything particularly large, but on a few things. And we’re simply going to have to get more selective.”

For most of the last year, Warner Bros. Discovery executives have echoed that theme, signaling a time for belt-tightening and discipline in its spending, though not retrenchment. Recently, CEO David Zaslav took a more optimistic tone.

“We have the NBA for another couple of years and hopefully for the long term,” he said recently on CNBC, adding that sports would power their domestic and global streaming strategy.

Those two companies also have been measured in their reliance on sports streaming. While ESPN has seen its streaming app “grow nicely,” Iger said, and Disney hopes to pivot ESPN into streaming over time, he added that Disney is “not going to do that precipitously.”

Expectations for the next rights deals are varied.

John Skipper, the former ESPN president who negotiated the company’s last TV deal with the league and is now CEO at Meadowlark Media, said on the Dan LeBatard Show podcast recently that he believed the NBA “will get somewhere between 200 and 350 percent more money in this round of deals than they did last time.”

Other media executives and analysts believe the deal could land between two to two-and-a-half times the current annual average value. Another model of a future NBA rights deal, performed by a person with knowledge of the league, forecasts a 70 percent increase in average annual value on the current deal, roughly in line with the bump the NFL received in 2021.

The scale could be determined by how much the NBA is willing to split up its rights and to where, as it walks the line between accessibility and revenue. It remains a very attractive rights package, both for its volume of inventory and because of how often it is consumed.

While its television ratings have remained generally flat this regular season — averaging about 1.6 million viewers across TNT, ESPN and ABC, which is down 21,000 viewers compared to last season — it’s still valuable as the number of homes with cable TV shrink every year and the league grows its share of them. The NBA’s playoff ratings, however, have boomed so far, with some games putting up pre-cord-cutting numbers. That only enhances the league’s case to potential rights holders.

That the NBA will have its global rights available on the market, not just domestic, could help increase the deal it ultimately lands.

The league could also increase its rights fees by not only adding streaming networks but also by giving more of its games to them. Apple bought out the MLS schedule, becoming the go-to stop for the league’s fans. The NHL put a number of games exclusively on ESPN+, as well over 1,000 out-of-market games.

“Two-x is feasible, for sure,” said William Mao, a senior VP of media rights at Octagon. “And that a 3x would come through some combination of other levers being pulled. In recent deals that’s usually putting a material share of content exclusively behind a subscription service. … (The NHL) deal with ESPN put a lot of content behind ESPN+. They still exist in the traditional linear television space not only with ESPN but also with Warner Bros. Discovery Sports, so they didn’t fully go like MLS did but that was, in our opinion, something that really unlocked that incremental rights value for the NHL in their last deal.

“So it’s either that or a variant of that is one of the big tech players is party to the next deal in terms of having one of the packages because you have seen it’s still generally a situation where they kind of have to quote pay up relatively speaking, to acquire that package.”

The NBA’s current TV deal accounts for roughly 30 percent of basketball-related income, and that will surely jump with the new deal. But teams were unable to project future salary-cap levels, making franchise planning more difficult. The new CBA will alleviate some concerns, capping annual cap growth to 10 percent and installing cap smoothing after a large spike in 2016 rocked the league.

The question now is how it will all look. Change is coming, and it will be valuable for the NBA. But it also will change the viewing habits of its longtime fans.

www.espn.com