- Apr 4, 2008

- 75,037

- 24,437

Rules for Investing

Useful Websites for Research

People to follow on Twitter

Rules for Trading

- Invest in the best: be in the most consistently growing industries with large TAM and long runways for growth. Investing is all about growth, and where companies/industries will be in five years. Where they’ve been doesn’t matter, it’s where they are heading.

- Avoid dinosaurs that have had their day: they say to own a stock in its second inning and sell it in its seventh. You don’t want to be holding onto a legacy that has no future that is growing out of favor and producing a low or negative CAGR. Coal stocks are dead for a reason. Legacy retailers are dead for a reason. Identify which legacy providers are in the ninth inning and avoid them like the plague: oil, airlines, movie theaters, commercial real estate and to an extent financials (they’ll recover because the world needs them to) are at the end of their ropes.

- Identify thematics that are revolutionizing the world and scalable: 3d printers are world changing, but they are nowhere near scalable. The future leader hasn’t been created yet. They take too long, and are too labor and capital intensive to make an impact. The theme is amazing but not feasible for now. Solar was at that point in its infancy. To invest in these themes before they can scale is to take a gamble on a fad that turns into something. Look for the company that is growing, innovating and scaling faster than their peers and delivering technologically like Tesla has. The themes for today that are scalable and life changing: digital transformation (SaaS, cloud, devOps, e-commerce), war on cash (fintech, payments,digital wallets), robotics (AI, Machine Learning, Full Self Driving), genomics (CRSPR, genetic testing to prevent late stage cancer), plant based revolution, WFH, Fitness as a Service, CTV. Each of these themes is scaling, growing and at the tip of the iceberg with large TAM’s.

- Own outstanding companies growing rapidly and leading the way in their thematic. Sales growth drives stock prices. If you have weak or decreasing revenue growth, your stock will eventually plateau unless it is a cash generating machine (FAANMG). Look for stocks with revenue growth over 50% in large TAM, Gross Margins over 50% (tech should be closer to 70%+), FCF trending toward positivity (AMZN lost money forever on paper but their FCF was positive), earnings growth over 50%, DBNER (for software) over 120%, minimal cash burn and expenses focused on R&D and S&M (SNOW has their losses because of their rapid land and expand efforts, AMZN has their losses because of their massive R&D, NFLX has theirs for content creation). Losing money is ok if it’s for the right reasons and resulting in growth with a map toward profitability that is being realized.

- Invest in the best: buy companies run by hungry CEO’s who are focused on fulfilling their vision and growing their companies. Innovation is imperative, but execution dictates success. You want to be involved with the Steve Jobs’s of the world (Elon Musk, Tobi Lutke, Jeff Lawson, Todd McKinnon, Joshua Bixby, Jack Dorsey, etc) and avoid the sideshow promoters like Trevor Milton. A CEO must deliver and fulfill his vision to continue earning your money, they should never be doing any promoting. Their company’s success should do the talking.

- Be flexible in your timeframe: you should be investing for the next 5-10 years and you must keep perspective on this journey, but you need to be flexible and willing to change when the business changes first. Keeping perspective means don’t worry about everyday price fluctuations and the gyrations of the market. Ebb and flow is healthy and normal if the stock is continuing to grow fundamentally. But if the growth story changes, or the management becomes less reputable, be flexible and protect your assets.

- Make your decisions based on fundamentals and technicals not PnL’s: just because a stock has gone up 100% doesn’t mean it’s now a sell or an avoid. In fact, a stock that organically went up 100% will probably wind up going 300%+ (as long as it wasn’t a fad being promoted on bs PR’s). When the fundamentals are good, and institutional support is being shown, there is no reason to sell. Do not sell a stock because it has gone up too much, and do not avoid a stock because it looks expensive, focus on the growth story and the trend. If the technicals are as equally good as the fundamentals, you’re most likely looking at a 5-10 bagger. Why cut that journey off short? Move your stop to break even and go from there, selling only when the growth slows or the chart shows topping action (the William O’Neil book is your friend for that).

- Buy stocks when the suits do: when you see a stock explode on a huge volume day off of an actionable piece of news that is company defining, join the suits and jump into the fray. Power earnings gaps are the easiest set ups to confirm a stock’s merit. Just because a stock ramps up $70-100 after hours on a great earnings report doesn’t mean the stock is no longer buyable. In fact, this is the most buyable stock on the street. Massive volume run rates and holding the gap is the biggest sign of confirmation out there. Look at TWLO in its first report after the pandemic started. The stock ran $70+ after hours from $105 to $175+. If you avoided the move then or sold out, you would be watching from the sidelines as it’s growth story continues and it sits at $330 seven months later.

- Never buy and hold, instead, focus on buying and holding. Your average doesn’t mean anything if the stock is growing and your 5-10 year CAGR indicates a much higher stock price than today. You should be adding to your winners every time they clear a new buy point. Even if it’s just one share, a stock clearing a buy point is confirmation, and with confirmation of a good investment must come conviction. You need to be cutting your laggards and your losers and using that money to add to your best winners.

- $5 stocks are $5 for a reason: don’t buy or avoid a stock based on its stock price alone. Stocks are rarely mid priced by the market. A stock can look overvalued and continue to grow even more overvalued. A stock can look undervalued and file for bankruptcy within the next few years. You want to avoid hunting for value and instead search for opportunity. Occasionally the market doesn’t fully understand the story and thematic, that is different than the stock being undervalued. Do not go bargain hunting in the bin full of dinosaurs waiting to die. GE is dead for a reason. F is dead for a reason. JCPQ has a Q for a reason. Sears is no longer with us for a reason. Oil will be dead for a reason. Yesterday doesn’t pay tomorrow’s bills.

Useful Websites for Research

CMLViz.com

Koyfin.com

FinViz.com

SimplyWallST

MarketSmith - expensive

Koyfin.com

FinViz.com

SimplyWallST

MarketSmith - expensive

People to follow on Twitter

Each one of these people, to me, is a must follow and has provided value.

@OphirGottlieb - CML Pro CEO

@saxena_puru - he's been an annoying **** past couple of weeks, but his portfolio updates are worth it for idea generation

@hiddensmallcaps - just started following him, good for genomics

@cfromhertz - excellent trader, posts lots of great ideas, runs a solid chat room (not a member but I've known him on twitter for a while)

@wallstjesus - unusual options activity

@openoutcrier - news

@canuck2usa - trade ideas

@investorslive - if you want to day trade he is a must follow and his chat room is the best in the business for momentum trading. do not ask him for buy/sell tips or anything "dumb", this is the big leagues, ie 6 figures a day big

@traderstewie - great for ideas and charts

@danshep55 - good for ideas

@optionshawk - options ideas

@bradloncar - biotech writer

@hedgemind - hedge fund follower

@adamfeuerstein - biotech writer, broke the remedesivir story in march

@alphatrends - charts

@muddywatersre - short hitman

@kerrisdalecap - short hitman

@stockhollywood

@modern_rock - when he's short a momentum stock, you know it's garbage

@citronresearch - you already know

@szaman - ideas, charts, day trading

@kunal00 - same ^

@jimcramer

@semodough - fire content

@sprucepointcap - short hitman

@rampcapitalLLC - lulz

@oddstocktrader - day trader, momo, OTC

@offshorthunter - swing ideas

@markflowchatter - news

@elkwood66 - when he's short a big momentum move, it's a bs stock (GNUS, SRNE)

@canny4 - that real talk

@sunrisetrader - ideas

@reddogt3 - ideas

@eliteoptions2 - options

@trendspider - charts

@patternprofits - ideas

@jfahmy - ideas

@malibuinvest - ideas/charts

@investing_city - Jesus follower who invests

@allstarcharts - charts

@rachels_44 - options

@tmltrader - charts

@duckman1717 - charts

@traderamogh - ideas

@tcmllc- ideas

@beth_kindig

all the 7investing people

@cperruna - charts, ideas

@Richard_chu97 - health tech

@martychargin - ideas/charts

@deltaone - news

@dhaval_kotecha

@RichardMoglen

@adventuresinfi

@StackInvesting

@alphacharts365

@IanGrayLive

@hhhypergrowth

@moon_shine15

all the ark people

@StockMarketNerd

@jablamsky

@SeifelCapital

@TerraPharma1

@skaushi - good spac trader

@JoeySolitro - great ideas

@DPogrebinsky

@Soumyazen

@HedgeyeComm

@SatoshiAlien - supply and demand zone pivots, very useful

@OphirGottlieb - CML Pro CEO

@saxena_puru - he's been an annoying **** past couple of weeks, but his portfolio updates are worth it for idea generation

@hiddensmallcaps - just started following him, good for genomics

@cfromhertz - excellent trader, posts lots of great ideas, runs a solid chat room (not a member but I've known him on twitter for a while)

@wallstjesus - unusual options activity

@openoutcrier - news

@canuck2usa - trade ideas

@investorslive - if you want to day trade he is a must follow and his chat room is the best in the business for momentum trading. do not ask him for buy/sell tips or anything "dumb", this is the big leagues, ie 6 figures a day big

@traderstewie - great for ideas and charts

@danshep55 - good for ideas

@optionshawk - options ideas

@bradloncar - biotech writer

@hedgemind - hedge fund follower

@adamfeuerstein - biotech writer, broke the remedesivir story in march

@alphatrends - charts

@muddywatersre - short hitman

@kerrisdalecap - short hitman

@stockhollywood

@modern_rock - when he's short a momentum stock, you know it's garbage

@citronresearch - you already know

@szaman - ideas, charts, day trading

@kunal00 - same ^

@jimcramer

@semodough - fire content

@sprucepointcap - short hitman

@rampcapitalLLC - lulz

@oddstocktrader - day trader, momo, OTC

@offshorthunter - swing ideas

@markflowchatter - news

@elkwood66 - when he's short a big momentum move, it's a bs stock (GNUS, SRNE)

@canny4 - that real talk

@sunrisetrader - ideas

@reddogt3 - ideas

@eliteoptions2 - options

@trendspider - charts

@patternprofits - ideas

@jfahmy - ideas

@malibuinvest - ideas/charts

@investing_city - Jesus follower who invests

@allstarcharts - charts

@rachels_44 - options

@tmltrader - charts

@duckman1717 - charts

@traderamogh - ideas

@tcmllc- ideas

@beth_kindig

all the 7investing people

@cperruna - charts, ideas

@Richard_chu97 - health tech

@martychargin - ideas/charts

@deltaone - news

@dhaval_kotecha

@RichardMoglen

@adventuresinfi

@StackInvesting

@alphacharts365

@IanGrayLive

@hhhypergrowth

@moon_shine15

all the ark people

@StockMarketNerd

@jablamsky

@SeifelCapital

@TerraPharma1

@skaushi - good spac trader

@JoeySolitro - great ideas

@DPogrebinsky

@Soumyazen

@HedgeyeComm

@SatoshiAlien - supply and demand zone pivots, very useful

- Elevator Pitch: only trade real money when you can create an elevator pitch for the kind of trader you are and the set ups you like to trade. I like to trade stocks that enter price discovery and use the MarketWebs to determine entries and exits. If you don’t know what type of trader you are or the set ups you like trading, you’re not ready to leave the paper trading platform.

- Wait for your Edge: the worst thing to do is to trade because you are bored or want to make money. This always ends up in mistakes and failure and sloppy performance that compounds negatively on your emotional and psychological health. Instead, be patient and let the set ups occur naturally. You do not need to chase trades or force them, you need to hit them hard when they are there and you have an edge to bank on. I had 3 losing trades today. 1 was a genuine stop on CRWD where I went long a call on it entering into value and anticipating price discovery. The stock failed and soon fell out of value. Since It was a call in a wide market, I lost more than I normally would have liked, but it was ok since I could live with it in terms of my portfolio and performance. But it bothered me that I lost money so I felt on edge all day to trade and try to make it back. I felt bored. So I wound up going long Apple and Fastly twice with no edge, no real plan and burned a couple of bucks that I didn’t need to lose. This was the result of me not having an edge and losing perspective, which brings us to…

- Always Keep Perspective: a bad day is just that, a bad day, they happen. Don’t let losses compound by breaking rules and losing track of your emotions. You should never have big bad days, all your losses should have been preplanned at the beginning of your trade and you should have accepted the potential and moved on. If you didn’t, you were loose with your stops or didn’t have a plan or an edge. Fix that and relax. Everything will work out in the long run if you trust your process.

- Create a Plan and EXECUTE: Never trade without a plan, make one, wait for it and execute when it is there. The plan should include where you stop, where you scale in, where you exit. If you can’t answer those three points, you are playing with fire and leaving yourself susceptible to emotions. Avoid that. Always make a plan the night before or morning of and focus on it. Follow it. Adjust when needed.

- Practice Patience: don’t get antsy, don’t get bored, don’t get impatient, just chill and wait. You need to be like a cheetah chilling in the forest, hiding behind some bushes, waiting for that sick animal to stop in front of you. That’s how you should wait for a trade, and that’s how you should wait for a trade to work when it is working for you. When your stop is hit, you get the hell out quickly. When you target is hit, you get the hell out quickly.

- Monitor the Market: Be careful of trying to trade upside pivots in a weak tape. Monitor the market and let your approach fit into the bigger picture. If you have a stock bucking the trend, great, otherwise chill.

- Risk Management: Cut your losers off quickly and let your winners run. Learn how to scale in and out of positions. Don’t sell until you get a sell signal. Be comfortable with your stop and live with it if it means letting a stock work.

- Healthy Mind, Body, Spirit: believe it or not, the emotions you carry will impact you so if you don’t feel 100% ready to dominate, you should just chill and avoid trading. Never trade after a bad day or when you are angry or emotional. Trading should be a boring, zen like experience where you are literally waiting for opportunity to occur.

- Be Confident and Trust Yourself: if you’ve been finding consistency and understand what you need to see and what you need to do, you should never worry or second guess yourself. Trust your abilities, trust your wisdom, trust your knowledge, trust your process.

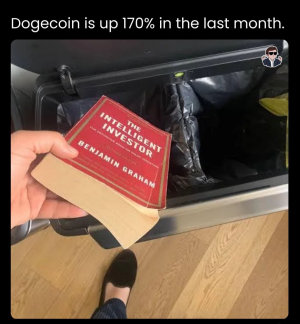

- Never Worry About Gainz: it might be hard at first to see other people making ****loads of money and you’re sitting there with a couple of pennies in your pocket, but that’s not your problem, and that’s not their problem either. Money comes in time, this should be a journey that you focus on internally. Any relationships you develop should be utilized to support, inspire and educate you. You should never look at someone with jealousy and wish you were them. You should learn from their journey and focus on yourself and bettering your lifestyle and your abilities through organic hardwork.

- Focus on Consistency: money comes in the end, but consistency is the catalyst that drives growth, success, security and independence. If you can make $1, you can make $100, if you can make $100, you can make $1,000. It’s all about scaling. Your goal shouldn’t be to make $1,000 a day in the beginning. Your goal should be to be consistent and consistently make good trades. Eventually, you’ll have the ability to compound, scale up and your account will grow immensely. If you’re able to trade well consistently, you just acquired a life skill that no one can take away from you. Who cares if you get rich today or tomorrow, if you’re consistent and you consistently follow your plan and consistently refine your process, you’ll be a multimillionaire in time and that’s all that matters

Last edited:

I gotta stop being complacent.

I gotta stop being complacent.