- 8,287

- 7,115

- Joined

- Aug 19, 2015

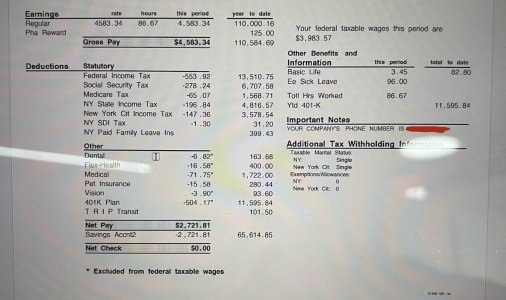

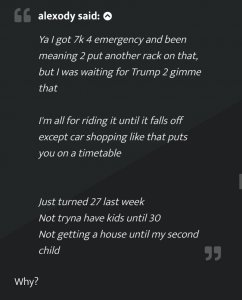

Yeah, I have extra Job income and drone based income to pay extra monthly, like around 700 a month to attack debt with. The drone income is variable though sometimes I make more sometimes less.

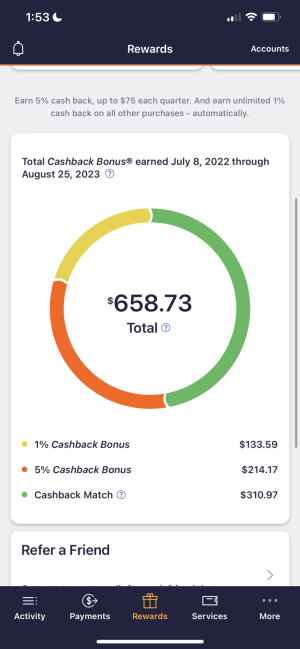

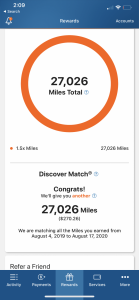

And discover max is at 10k

But I see your logic on the 30%

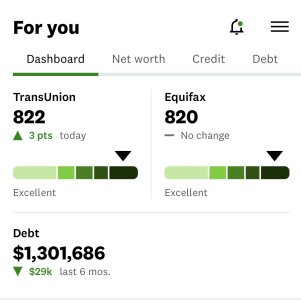

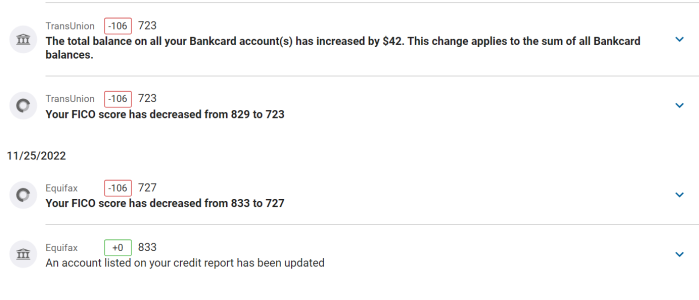

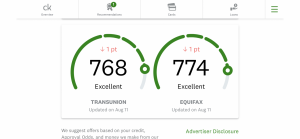

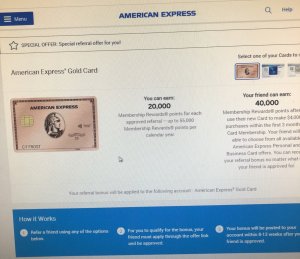

One of the 0% balance transfer cards might help you out with your situation (debt + wife surgery), to give you time to chop it down. That said, you'd probably want to get your balances down to 30% or less, let your credit score increase a bit, and then apply for the 0% card. If the Discover card limit is $10k, you should use about half of your $6.3k cash to pay it down to under $3k, then do the same for the Chase and CapOne if you can.

If you do go the Balance Transfer route, make sure you pay off the debt within that 0% time frame. Don't just delay it thinking you have 12-18 months and start buying **** to go even further into debt. Not saying thats what you'd do, just that a lot of people get caught into that trap and procrastinate.