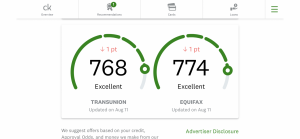

Let me give a brief history on my crappy credit and how I've been able to hit 760s in less than a year.

I never really cared to much about credit, and would pay late and pay minimum on low balanced cards ($1200). Went through a rough patch 5 years ago and a few accounts went into collections.

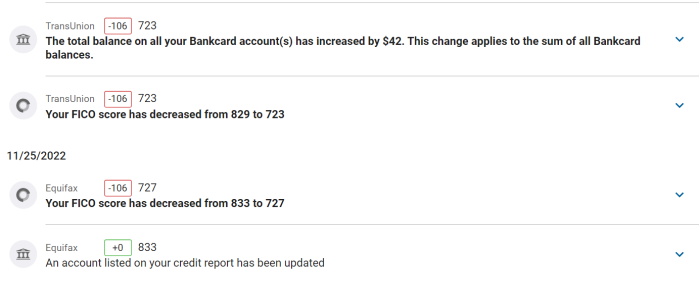

About 1.5 years ago, a family member hooked me up with a navy federal account. I didn't use it till I used them to purchase a used car at a low rate. At the time my score was about 620 with collections and derogs and a utilization of about 75% of low limit cards. I listened to Ramseys money make over, took some tips and payed off my low limit cards. I was able to get 2 cards from navy fed at 25k, each. Once that happened my score jumped to 720s. I paid off one account in collections which was about 2.5k and disputed another and surprisingly, the dispute was in my favor. Currently I'm at 25% utilization, no derogs, no collections. I use one card to pay rent and stack the points. The other card I use here and there. I plan on adding my son to my credit account so he can build his credit off of me and teach him, lessons I learned. My biggest surprise was winning disputes through credit karma. It was crazy easy and didn't even have to talk to anyone. I suggest utilizing it cause you never know. My whole goal was to get my credit up to Par for when I'm ready to get into the real estate game. For you guys having a hard time building, check out your credit unions