Yes

@HankScorpio the rule of thumb is to use a max of 10% of total utilization and a max of 30% utilization per card.

I wish I would have never opened up the Gold Premier Rewards card with AMEX. I should have went the CC route with AMeX. Im young so I think I will have to keep this card for atleast 5 years.

You should keep it active at least. Getting the Amex CC is def the way to go. Apply for the Blue card and wait 61 days until you ask for a 3x credit limit increase. AMEX will grant it 99.9% of the time, just as long as you're in good standing with the card.

@HankScorpio

The chase freedom is actually the one i got denied for. When i called the reconsideration line the guy told me my only asset is my car which is seizable and he needed to see non seizable assets, but my score itself was fine.

Hmm, sounds weird to me. What exactly is your credit score? From what I've been hearing and reading recently is that they're trying to raise some requirements for the Freedom. If I were you, I'd probably try to go for the QuicksilverOne. It'll be a soft inquiry, so it won't hurt your score so much.

@hankscorpio what's the best credit card to get for someone who has excellent credit (high 700s) to be exact, I pay back everything in full every month. Just looking to get a new credit card with a lower apr,

I think DLee already answered this question, but I'll give it a go-around.

it really depends what kind of features or benefits you're looking for. Right now, the best cards out there would be...

-Chase Sapphire Preferred

-Barclaycard Arrival Plus

-Citi Prestige

-American Express Platinum

I do agree you should pair those cards with an excellent cash back card. Which would be..

-Chase Freedom

-Discover IT

-Citi Double Cash

-Capital One Quicksilver

Personally, I have the Freedom, Sapphire Preferred, Barclays Arrival Plus, and Amex Platinum. I travel a lot and I use cash back for a ton of my purchases. With the amount of points I add on, I can transfer them to any rewards programs i'm in.

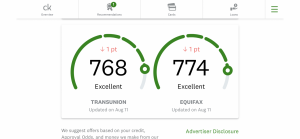

Credit score is around 815ish right now

I'm in the same boat as you. I have a 750 Score, I signed up for the United Mileage Plus from Chase. They give you 50,000 bonus miles for United Airlines. Then another 5,000 if you add an authorized user and they make a purchase. The catch is you have to spend $2,000 in the first 3 months.

Which is easy if you have the cash, and just use credit cards to get bonuses. ( Like I do)

- So you can redeem the points on United ( or a star alliance member airline)

- You can get 2 Free Roundtrip Domestic Airline Tickets

- Or get a FREE Roundtrip to Europe

I'm going to vacation in the summer to Egypt, so I'll probably end up paying less than $150 for extra miles if I don't make the count by the time I book my flight.

Look into the Sapphire Preferred or the Barclays Arrival Plus. The features better suit your needs.

dk if its a coincidence, but I was accepted pretty easily for a chase card and I think it's because my parents each have cards with chase with high limits and pay their bills on time. Also, I was added on to my moms about a year before I applied so that probably didn't hurt.

I'm not so sure what they use to consider applications, but I doubt you're parents having Chase account s or you being on the account has anything to do with your credit. I could be wrong though and maybe it is taken into consideration, but I can't see why or how.

Instead applying for a new card, which will ding your credit score, you should rather call your (present) credit card company and negotiate for a lower rate.

...

This is good advice.

I was going to make a thread on this but I'll see if I can get the answer in here before I do-

Long story short, I owe Verizon $400+ dollars and they sent me to collections. It was for a early termination fee I thought was covered by a previous payment but I totally forgot I had that paynent refunded to me.

Anyway, I've been getting the letters from the different collection agencies that took this debt on. A couple months ago I got one offering me to pay the debt out for like $200ish which sounded great but I didnt have the money.

Since then, I've gotten letters asking for the full $450, until yesterday, when I got another offer to settle at like $200.

Heres my question- what is the very best wat to go about handling this debt? Should I pay this collection agency? Should I hire a lawyer? How do I handle this situation so my credit is effected most positively. I know at the moment its not good being in collections but whats the best way to start correcting this? Paying the debt or what? Maybe calling Verizon? (Probably not because its in collections)

I've basically been waiting to settle this before I open a card and finally star building my credit. Gona have to sign up for some bs card because this debt probably put a dent in my already non existant rep.

Any input is appreciated.

Whatever you do, do NOT default on the debt. If you settle for $200, it will come up as a default on the debt in your credit report. I don't think calling Verizon will do anything at this point, considering a debt collections agency has taken over the debt now.

If I were you, I'd speak with someone from the collections agency and ask what the best option for you would be so you're credit can be positively affected. I would imagine you try to pay off the entire debt in full. Settling or defaulting in a debt is BAD NEWS. That ish will stay on your record for 5-7 years man (depending on which state you live in).

. The reason I signed up for it was because of the 50,000 k points bonus when I spend 1,000 in 3 months. Hit that mark in the first billing cycle

. The reason I signed up for it was because of the 50,000 k points bonus when I spend 1,000 in 3 months. Hit that mark in the first billing cycle