- 17,129

- 8,043

- Joined

- Feb 8, 2014

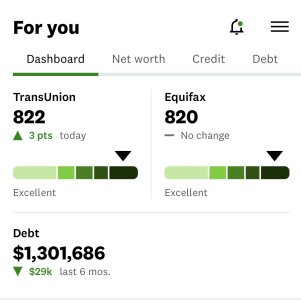

Exactly..33 housing (principal interest taxes insurance)Wait. Maybe I’m thinking about this the wrong way or backwards or something, but do you mean your total housing payment cannot be 31% (or more I guess) of your income? And your housing payment with all of your other debts can or exceed 41% of your income?

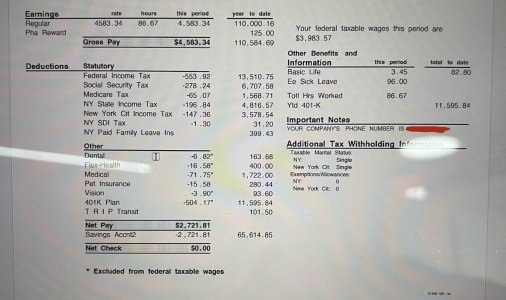

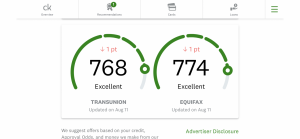

41 housing with all ur other debts..they use ur credit report to get the figures

off ur monthly income

Sorry if the wording may been confusing

*** if ur ratios are too high we suggest paying a debt off to make it lower

Source: I'm an underwriter