- 5,067

- 1,133

- Joined

- Mar 10, 2004

quick question:

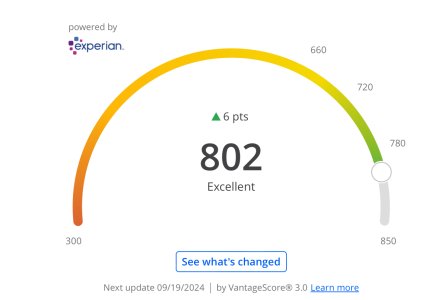

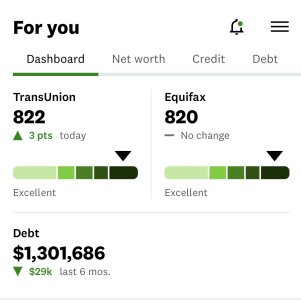

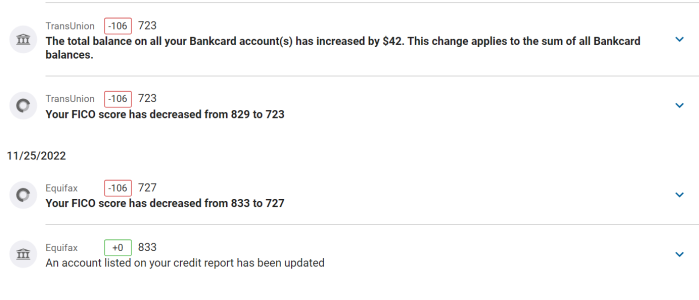

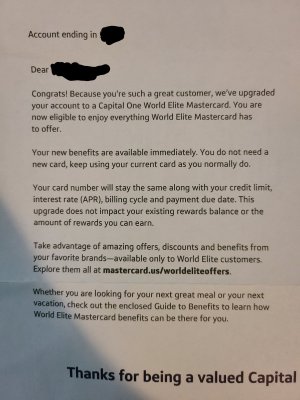

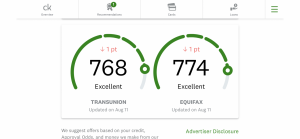

i just paid off 2 of my 4 cards, and im thinking about closing one out. should i close it or just leave it open? ive had the account for 5 years.

i just paid off 2 of my 4 cards, and im thinking about closing one out. should i close it or just leave it open? ive had the account for 5 years.

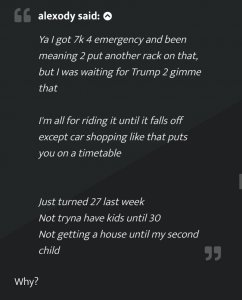

that post was the definition of not reading the post you're quoting

that post was the definition of not reading the post you're quoting